Throughout history, financial markets have experienced devastating crashes, wiping out trillions of dollars and affecting economies worldwide. Here’s a look at ten of the worst stock market crashes, ranked by financial loss.

1. 2008 Financial Crisis (2007–2009)

The 2008 Financial Crisis, known for its massive scale, obliterated $8 trillion in global market value. As housing prices plummeted, financial institutions like Lehman Brothers collapsed, sending shockwaves worldwide. The crisis, sparked by subprime mortgage defaults, revealed significant flaws in financial regulations.

Governments intervened with massive bailouts to stabilize economies. A sense of fear gripped investors, leading to drastic market drops. Many lost their savings, and unemployment soared across nations.

This period marked profound changes in financial oversight, highlighting the interconnectedness of global economies and the dire consequences of financial mismanagement.

2. Dot-com Bubble Burst (2000–2002)

The Dot-com Bubble Burst wiped out $5 trillion as overvalued tech stocks collapsed. This era saw rapid investment in internet companies, many lacking solid business plans.

When reality hit, the market corrected sharply, leading to bankruptcies and job losses. Investors who once dreamed of fortunes found themselves in financial turmoil.

This crash taught valuable lessons about speculative investing and the importance of sustainable business models. The tech sector eventually recovered, but the scars of this dramatic downturn lingered for years.

3. Black Monday (October 19, 1987)

Black Monday remains infamous for its one-day $1.7 trillion loss. Program trading and panic selling drove the Dow Jones down by an astonishing 22.6%.

This unprecedented drop left traders and investors reeling. The sudden crash was a wake-up call for regulatory bodies to reassess trading mechanisms.

Following Black Monday, measures like circuit breakers were introduced to prevent future incidents. It remains a stark reminder of market volatility’s unpredictable nature.

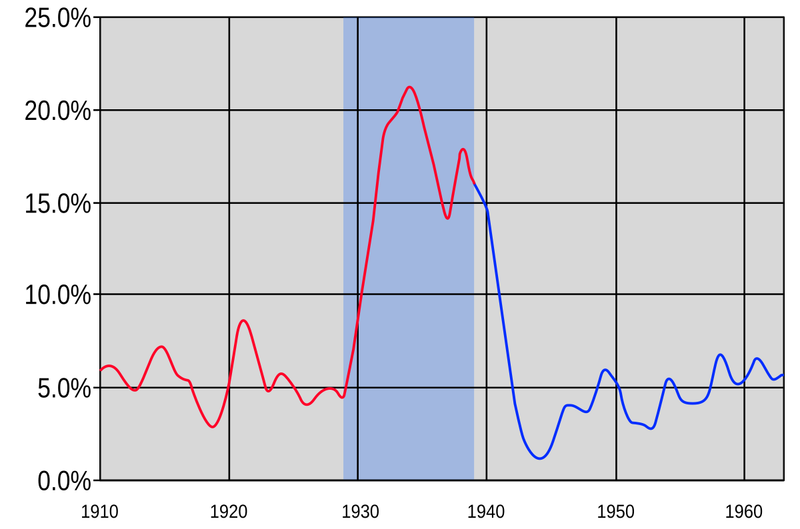

4. Wall Street Crash (October 1929)

The Wall Street Crash of 1929 marked the beginning of the Great Depression. In just two days, the market lost $1.3 trillion, causing widespread economic despair.

Investors who had heavily borrowed to invest found themselves bankrupt. Black Thursday, the initial day of panic, set the tone for a decade of hardship.

This crash highlighted the risks of speculation and led to reforms aimed at preventing such economic calamities. Its lessons endure, teaching caution in times of economic exuberance.

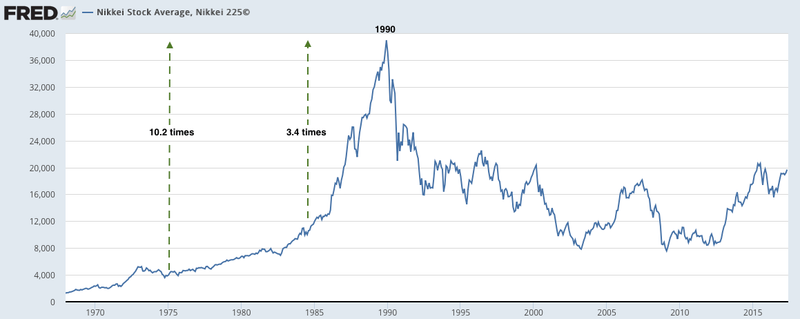

5. Japanese Asset Bubble Collapse (1989–1990)

The Japanese Asset Bubble’s collapse resulted in a $1.2 trillion loss, as real-estate and equity values plunged. The economic boom of the 1980s came to a sudden halt.

This crash ushered in Japan’s “Lost Decade,” characterized by stagnation and deflation. Investors watched their fortunes dwindle as property values plummeted.

The repercussions were felt globally, serving as a lesson in the perils of speculative bubbles and overvaluation. Japan’s experience remains a case study for economists worldwide.

6. Black Thursday (October 24, 1929)

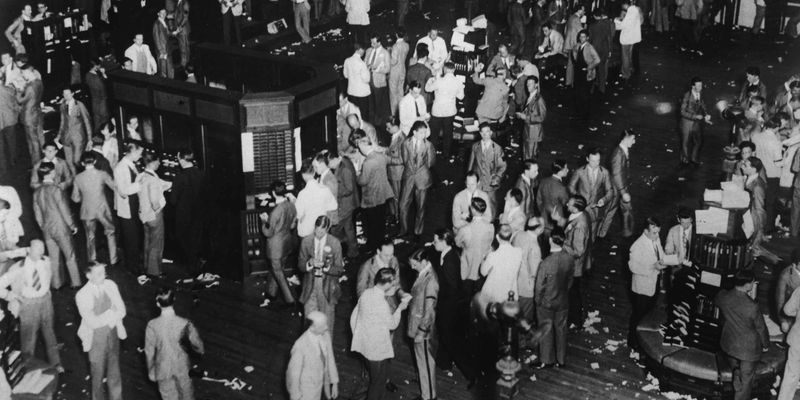

Black Thursday was the harbinger of the 1929 crash, with $1 trillion lost in a single session. Desperate selling overwhelmed the New York Stock Exchange.

Fear spread rapidly, leading to further declines and triggering the Great Depression. The chaos of that day is etched in history as a symbol of financial panic.

This event underscored the fragility of financial markets and the devastating impact of mass hysteria. It emphasized the need for market stability and investor confidence.

7. 1987 Global Crash (October 1987)

The 1987 Global Crash, sparked by Black Monday, cost $900 billion worldwide. Markets across continents plummeted, reflecting the interconnected nature of modern finance.

In response, countries coordinated efforts to stabilize the situation. Cross-border circuit breakers were put in place to prevent similar events.

This crash highlighted the global economy’s vulnerability and the necessity for unified action in times of crisis. It reshaped economic policies and international cooperation.

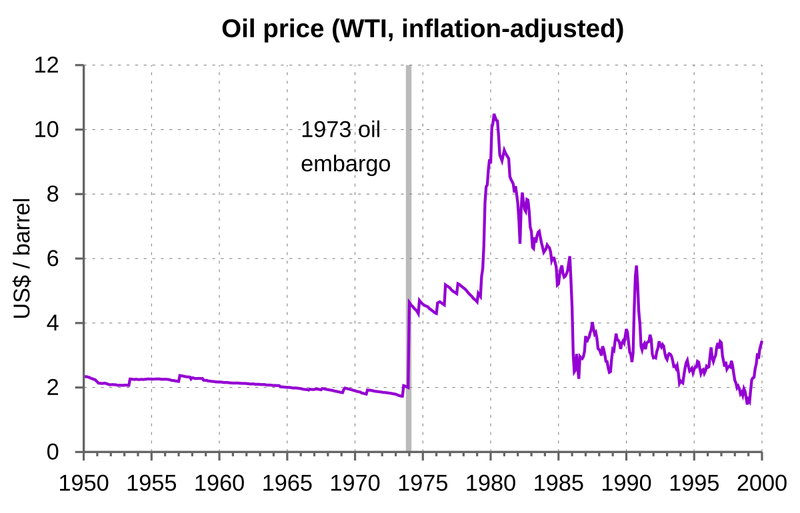

8. 1974 Oil Crisis Crash (1973–1974)

The 1974 Oil Crisis Crash saw an $800 billion market decline due to OPEC’s embargo. Energy prices surged, affecting economies worldwide.

The S&P 500 tumbled 48% over two years, as inflation spiraled out of control. Industries reliant on oil faced severe challenges, leading to job cuts and economic strain.

This period exposed the reliance on oil and prompted shifts towards alternative energy. It remains a pivotal moment in understanding energy’s role in economic stability.

9. 1937 Recession Crash (1937–1938)

The 1937 Recession Crash wiped out $750 billion, halting post-Depression recovery. Premature Federal Reserve tightening led to a sharp economic decline.

Investors faced significant losses as confidence waned. This downturn emphasized the delicate balance required in monetary policy.

Lessons from this crash influenced future economic strategies, highlighting the repercussions of aggressive fiscal policies during vulnerable times.

10. 1957 Cold War Crash (1957)

The 1957 Cold War Crash was marked by geopolitical tension and Sputnik fears. A $700 billion sell-off occurred as defense stocks faltered.

Investors reacted to rising uncertainty, leading to a broader market panic. This period underscores the impact of geopolitical events on financial markets.

The crash serves as a reminder of the interconnectedness between global politics and economic stability, influencing future investment strategies.