The Great Depression wasn’t just a bad day at the stock market. It was the most devastating economic disaster of the 20th century, leaving millions jobless, homeless, and hopeless. From 1929 to 1939, this economic nightmare changed how governments handled money and how ordinary folks viewed financial security. Understanding what caused this massive collapse helps us prevent similar disasters today.

1. Stock Market Crash of 1929

The financial world shattered on October 29, 1929 – Black Tuesday. Panic swept through Wall Street as stock prices plummeted, wiping out billions in wealth overnight. Investors who had borrowed money to buy stocks couldn’t repay their loans.

Regular folks who had invested their life savings watched helplessly as their future evaporated. The crash wasn’t just about numbers on a board – it represented broken dreams and shattered confidence.

Though not the only cause of the Depression, this dramatic collapse triggered a chain reaction throughout the economy, creating a psychological blow from which recovery would take years.

2. Banking System Collapse

Money vanished before people’s eyes as banks closed their doors forever. Without federal deposit insurance, when banks failed, customers lost everything. Between 1930 and 1933, nearly 9,000 banks collapsed.

The banking panic spread like wildfire. Rumors of a bank’s weakness would trigger a rush of people demanding their money back all at once. Even healthy banks couldn’t survive these “runs” since they didn’t keep all deposits in cash.

Each failure created a domino effect, destroying more banks and businesses. The banking system’s collapse froze credit and paralyzed the economy, turning financial problems into a full-blown catastrophe.

3. Overproduction Crisis

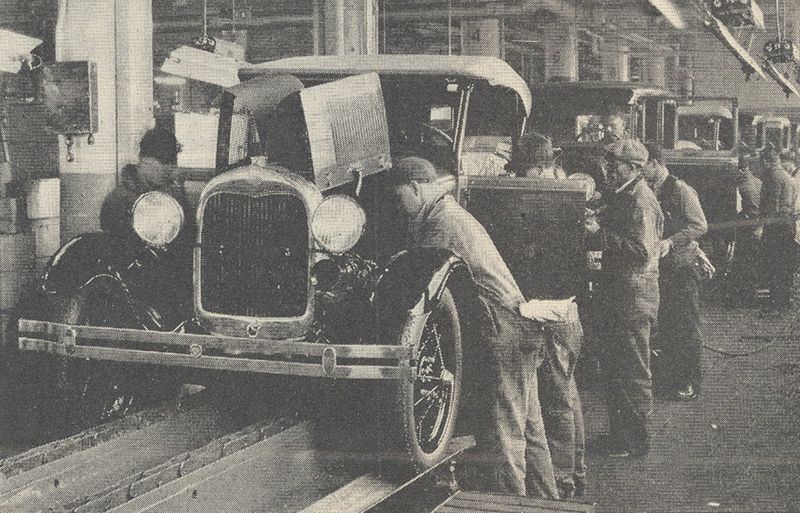

American factories hummed with efficiency in the 1920s, churning out more goods than ever before. New assembly lines and improved technology meant workers could produce items faster than people could buy them. This created a dangerous bubble.

Warehouses filled with unsold cars, appliances, and clothing. Companies slashed prices to move inventory, but still couldn’t sell everything. Eventually, they cut production and laid off workers.

Those unemployed workers couldn’t afford to buy products, creating even less demand. This vicious cycle of overproduction and underconsumption trapped the economy in a downward spiral that worsened the Depression’s severity and duration.

4. Agricultural Sector Collapse

America’s farmers suffered long before Wall Street crashed. After World War I ended, European agriculture recovered, reducing demand for American crops. Prices for wheat, corn, and cotton plummeted while farmers’ debts remained high.

Many had borrowed heavily to buy land and equipment during wartime prosperity. When crop prices fell by almost 60% between 1929 and 1932, farm income virtually disappeared.

Rural banks specialized in agricultural loans failed first. Farm foreclosures skyrocketed, forcing families off land they’d worked for generations. The agricultural crisis spread economic hardship from countryside to cities, as struggling farmers couldn’t afford manufactured goods, further weakening the national economy.

5. Dangerous Debt Levels

The Roaring Twenties created a false sense of endless prosperity. Americans embraced buying on credit like never before – automobiles, furniture, radios, and even stocks were purchased with minimal down payments and high-interest installment plans.

By 1929, consumer debt had skyrocketed to dangerous levels. When the economy stumbled, those debt payments became impossible burdens. Families who missed payments lost their purchases to repossession, while still owing money.

Businesses had also borrowed heavily to expand. When sales declined, they couldn’t meet loan obligations. This massive debt overhang made economic recovery nearly impossible, as both consumers and companies focused on paying down debts rather than new spending.

6. Wealth Inequality Gap

The prosperity of the 1920s wasn’t shared equally. While the nation’s total wealth grew, it concentrated at the top. By 1929, the richest 1% of Americans owned nearly 40% of the nation’s wealth, while the bottom 80% had just 10%.

This imbalance created structural weakness. The wealthy saved or speculated with much of their money instead of spending it on goods and services. Meanwhile, working-class families stretched thin couldn’t generate enough consumer demand to sustain economic growth.

When the crash came, the wealthy could weather the storm by reducing luxury spending. But for most Americans, any reduction in income meant immediate hardship, accelerating the economic freefall through drastically reduced consumer spending.

7. Federal Reserve Missteps

America’s central bank made critical errors that transformed a recession into a depression. Initially concerned about speculation, the Federal Reserve raised interest rates in 1928-29, hoping to cool the overheated stock market. This tightening came at exactly the wrong moment.

After the crash, instead of providing emergency liquidity to prevent bank failures, the Fed allowed the money supply to contract dramatically. Between 1929 and 1933, the American money supply shrank by about one-third.

This severe monetary contraction caused deflation—falling prices—which increased the real burden of debt. Borrowers now owed the same dollar amount, but those dollars were worth more, making repayment even harder and deepening the economic crisis through a devastating deflationary spiral.

8. International Trade Barriers

The Smoot-Hawley Tariff Act of 1930 slammed the door on global trade at the worst possible moment. Hoping to protect American jobs, Congress raised import taxes to record levels on over 20,000 imported goods. The plan backfired spectacularly.

Outraged trading partners immediately retaliated with their own tariffs against American products. International trade plummeted by nearly 66% between 1929 and 1934. American farmers and manufacturers lost crucial foreign markets overnight.

This trade war transformed what might have been a serious but manageable downturn into a worldwide depression. The collapse of international commerce meant economic misery spread globally, making recovery more difficult for all nations caught in this self-destructive cycle of protectionism.

9. Gold Standard Limitations

The international gold standard acted like economic handcuffs during the crisis. Under this system, each country fixed its currency’s value to a specific amount of gold, limiting how much money could be printed to what gold reserves backed.

When panic struck, people and banks hoarded gold, forcing governments to raise interest rates to protect their gold reserves. These higher rates choked off economic activity precisely when stimulus was needed.

Countries couldn’t implement flexible monetary policies to fight unemployment. Those that abandoned the gold standard earliest, like Britain in 1931, recovered faster. The United States remained shackled to gold until 1933, prolonging its suffering through monetary inflexibility when the economy desperately needed expansion rather than constraint.

10. Housing Market Bubble Burst

The 1920s witnessed America’s first nationwide real estate bubble. Florida led the speculative frenzy, with property changing hands multiple times in a single day at ever-higher prices. Similar bubbles inflated across the country as easy credit fueled construction booms.

Reality hit hard when this bubble burst. Construction virtually halted, throwing countless builders, carpenters, and suppliers out of work. Property values collapsed, leaving homeowners owing more than their houses were worth.

The housing crash devastated household wealth and triggered many bank failures. Banks had made risky loans on overvalued properties, and when those loans defaulted, the banks were left holding nearly worthless real estate. This sector’s collapse removed a crucial engine of economic growth when it was most needed.

11. Reckless Stock Speculation

Wall Street fever infected Main Street during the late 1920s. Ordinary Americans caught gambling fever, borrowing money to buy stocks on “margin” – putting down as little as 10% and borrowing the rest. This practice artificially inflated stock prices far beyond their real value.

Brokers encouraged this risky behavior, lending over $8.5 billion for stock purchases by 1929. When prices began falling, these margin investors faced “margin calls” requiring immediate repayment.

Forced to sell stocks to cover loans, they triggered more price drops, creating a devastating downward spiral. The crash wasn’t just bad luck – it was the inevitable result of a speculative mania fueled by easy credit, minimal regulations, and the dangerous belief that stocks could only go up.

12. Global Economic Instability

World War I left an economic minefield that eventually exploded into the Great Depression. European nations emerged from the conflict buried in debt, with damaged infrastructure and millions of productive workers dead or injured.

Germany faced impossible reparation payments that crippled its economy. When American loans that had been propping up European recovery suddenly dried up after the 1929 crash, the entire international financial system unraveled.

The collapse of Austria’s Creditanstalt bank in 1931 triggered a European banking panic that ricocheted back to America. This international economic instability created a global depression where no country could export its way to recovery, as all major markets contracted simultaneously, leaving nowhere to sell surplus goods.

13. Consumer Confidence Collapse

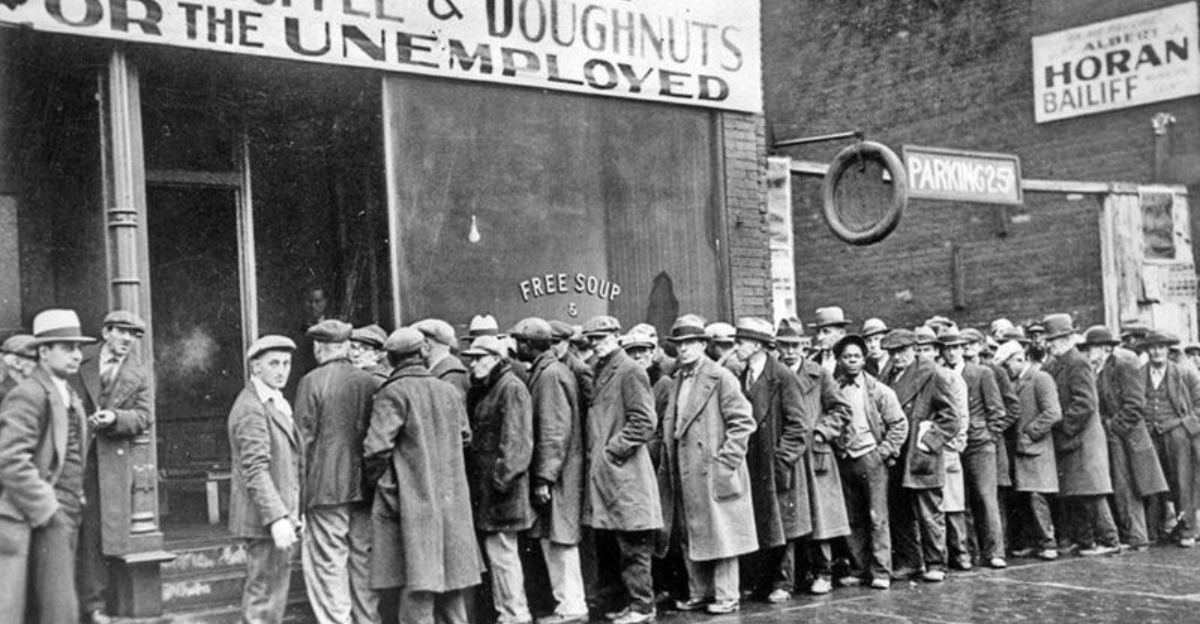

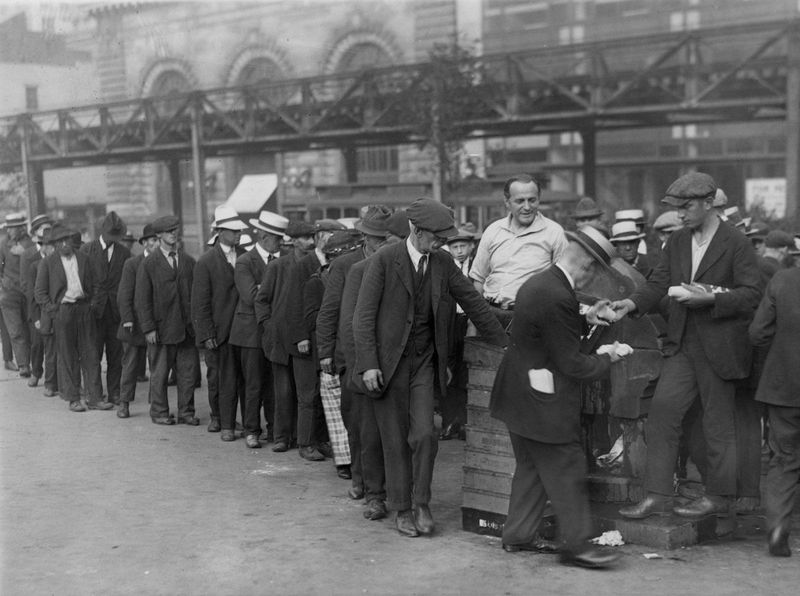

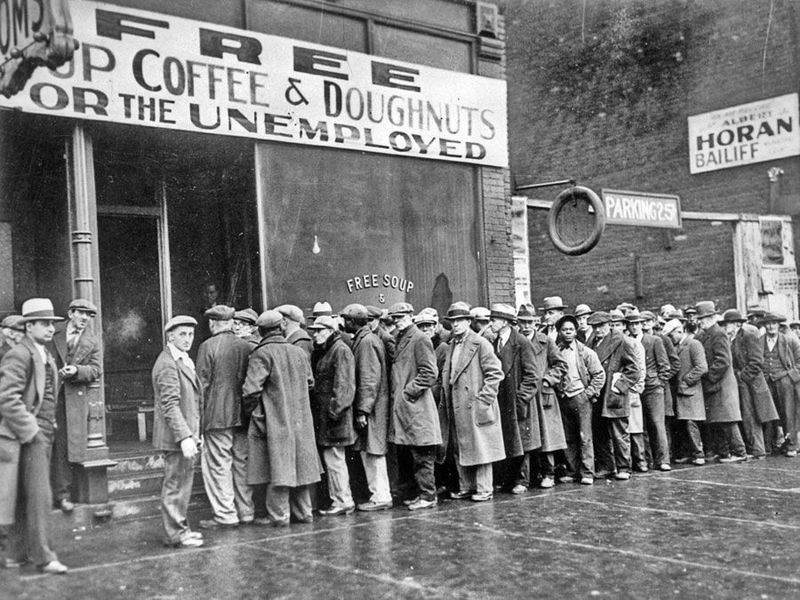

Fear itself became a powerful economic force during the Depression. As bad news mounted, Americans changed from optimistic spenders to fearful savers almost overnight. Even those who kept their jobs cut spending drastically, afraid they might be next to lose their income.

This psychological shift created a self-reinforcing cycle. Reduced consumer spending forced businesses to lay off workers, creating more fear and even less spending. The sight of bread lines and homeless families further damaged confidence.

Hoarding became common as people kept what money they had under mattresses rather than in banks or circulation. This massive collapse in consumer confidence transformed what might have been a severe recession into a prolonged depression, as psychological factors amplified and extended the economic downturn.

14. Government Policy Failures

When disaster struck, government responses often made things worse. President Hoover initially insisted the economy would heal itself, resisting major federal intervention. His administration actually raised taxes in 1932 to balance the budget, removing more money from an already cash-starved economy.

State and local governments also cut spending when they should have expanded it. Relief efforts remained woefully inadequate compared to the scale of suffering. The Federal Reserve’s failure to serve as lender of last resort allowed thousands of banks to collapse unnecessarily.

These policy mistakes turned a serious recession into a catastrophic depression. By the time more aggressive policies were implemented under Roosevelt’s New Deal, the economic damage had deepened so severely that recovery would take nearly a decade and require a world war to complete.

15. Environmental Catastrophe

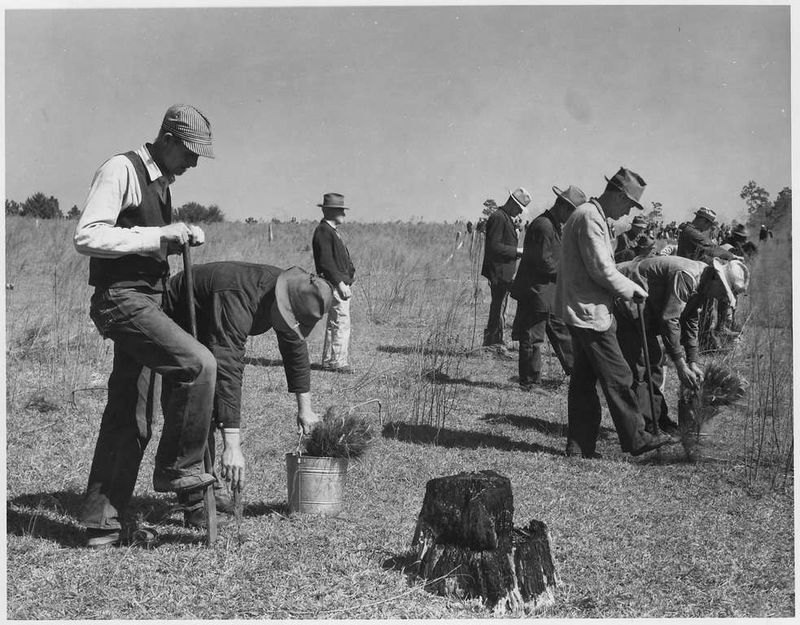

Nature delivered a cruel blow to an already suffering nation. Beginning in 1930, severe drought struck the Great Plains. Years of poor farming practices had removed native grasses that held soil in place. When drought-dried topsoil met powerful winds, massive dust storms were born.

The “Dust Bowl” made farming impossible across vast regions. Crops failed year after year, while livestock died from dust pneumonia or starvation. Families who had survived on their land for generations were forced to abandon their farms.

Thousands became environmental refugees, migrating to California and other states in desperate search of work. This ecological disaster deepened the Depression in rural America, creating a humanitarian crisis that strained relief efforts and added environmental collapse to economic collapse.

16. Structural Economic Weaknesses

The 1920s economy stood on shaky ground long before the crash. Key industries like textiles, coal mining, and railroads were already declining while new industries hadn’t yet grown large enough to replace them. Rural America never shared fully in the decade’s prosperity.

The automobile industry, which had driven much of the 1920s boom, reached saturation by 1929. Most households that could afford cars already owned them, and replacement sales couldn’t sustain previous production levels.

Technological advances increased productivity faster than wages grew, creating fundamental imbalances. These structural weaknesses meant the economy was vulnerable to shocks. When the crash came, these underlying problems magnified its impact and complicated recovery efforts, as policymakers failed to address these deeper economic imbalances.