They say nothing is certain but death and taxes—but what they don’t always say is how taxes have literally sparked revolutions, toppled monarchies, and reshaped the world map. Here are 17 times taxes didn’t just irritate people—they ignited history.

1. Salt Tax – French Revolution (Gabelle)

The French salt tax, or Gabelle, was more than just fiscal policy; it symbolized the deep-rooted inequality in pre-revolutionary France. The tax burden fell disproportionately on the poor, sparking widespread discontent. This injustice added fuel to the already simmering revolutionary fervor. Salt, essential for daily life, became a symbol of oppression. Violent protests and smuggling operations became common as resistance grew. The Gabelle’s unpopularity highlighted the old regime’s failure to address economic disparity, contributing to the French Revolution’s eruption. The fall of the Bastille was partly built on salt.

2. Tea Act (1773) – Boston Tea Party

The Tea Act of 1773 wasn’t merely about tea; it was about asserting dominance. By lowering tea taxes for the East India Company, Britain tried to undercut colonial merchants. The colonists didn’t sip their tea in silence. Instead, they organized the Boston Tea Party, where they dumped 342 chests of tea into Boston Harbor. This act of defiance was more than an economic protest; it was a statement of resistance. The Boston Tea Party galvanized colonial unity and fueled the revolutionary spirit, eventually leading to the American Declaration of Independence.

3. Window Tax – 18th Century Britain

Imagine being taxed for sunlight. The Window Tax in Britain literally put a price on daylight. Introduced in the late 17th century, this tax was intended as a wealth gauge, assuming more windows meant more wealth. However, it led to bizarre architectural changes, with many bricking up windows to avoid the tax. This tax unintentionally affected health by limiting light and ventilation, causing public outrage. The public’s disdain for this tax simmered for decades, symbolizing governmental overreach. It wasn’t just about money; it was about quality of life.

4. Poll Tax – Peasants’ Revolt (1381, England)

The Poll Tax of 1381 was a catalyst for upheaval in medieval England. Imposed by King Richard II, it required everyone to pay the same tax irrespective of their income. This regressive tax sparked the Peasants’ Revolt, as the impoverished masses could not bear the financial burden. Led by figures like Wat Tyler, the rebels marched on London, demanding justice and reform. They highlighted the glaring social and economic inequalities of the time. Though the revolt was ultimately crushed, it marked a significant shift in the power dynamics of England.

5. Salt Tax – Indian Independence Movement

In 1930, a march to the sea became a march to freedom. The British salt tax in India was a symbol of colonial oppression. Mahatma Gandhi’s Salt March to Dandi was not just a protest against taxation but a pivotal moment in India’s fight for independence. As Gandhi and his followers walked 240 miles to the Arabian Sea, they broke the law by making their own salt, inspiring mass civil disobedience. The Salt March united Indians against British rule and demonstrated the power of nonviolent resistance, leaving an indelible mark on history.

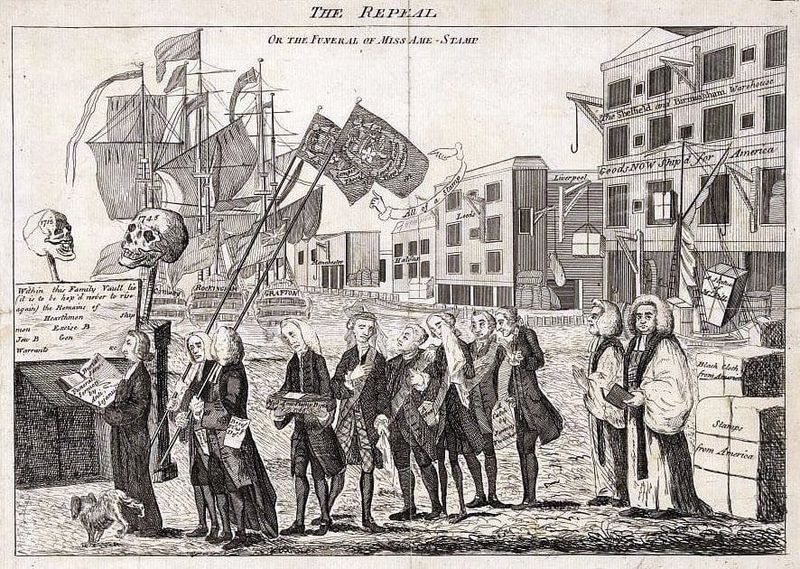

6. The Stamp Act (1765) – American Colonies

The Stamp Act of 1765 wasn’t just a tax; it was a tipping point. Colonists in America faced a British-imposed tax on every piece of printed paper, from newspapers to playing cards. “No taxation without representation” became the rallying cry. This wasn’t merely about money but about autonomy and respect. The uproar led to organized protests, boycotts, and ultimately the convening of the Stamp Act Congress. This unified colonial opposition marked a significant step toward the American Revolution. Without this pivotal moment, the colonies may have remained under British control for much longer.

7. Hearth Tax – 17th Century England

The Hearth Tax in 17th century England was more than just a fee on fireplaces. It was a measure of wealth, introduced by Charles II to fund the government’s expenses. Yet, it was widely despised, as it was seen as intrusive and unfair. Many households bricked up their hearths to avoid the tax, leading to colder homes and growing resentment. This tax contributed to the anti-monarch sentiment that simmered during the English Civil War era. It wasn’t just about warmth; it kindled a fire of dissent against the monarchy.

8. Stamp Tax – Dutch Revolt (Netherlands, 16th Century)

The Stamp Tax in 16th-century Netherlands was a spark for rebellion. Under Spanish rule, this tax was one of many oppressive measures that fueled the Dutch Revolt. As taxes mounted, so did anger and resentment. The Stamp Tax symbolized the broader struggle against foreign domination and economic exploitation. The revolt that followed wasn’t just about taxes; it was about freedom. This period of resistance led to the Eighty Years’ War, culminating in Dutch independence. The Stamp Tax was more than a financial burden; it was a rallying cry for liberation.

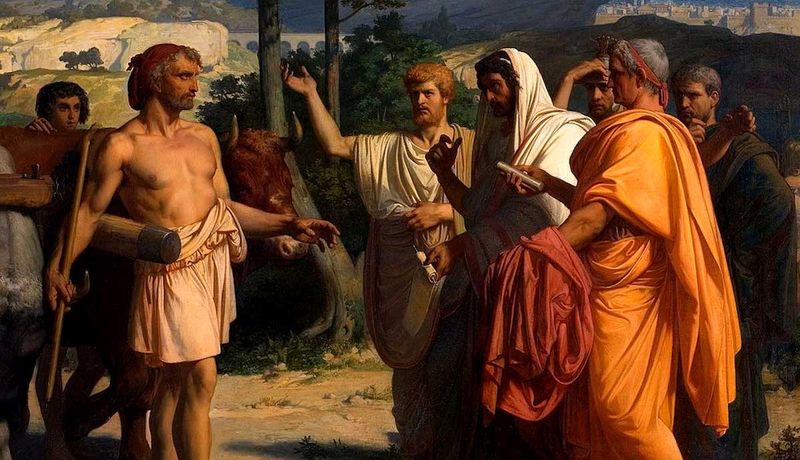

9. Grain Tax – Roman Empire

The Grain Tax in the late Roman Empire was more than a financial demand; it was a weight that pushed an empire to its knees. Overburdened farmers faced heavy taxation demands, fueling unrest and dissatisfaction. Corruption within the tax system exacerbated the situation, leaving many destitute. This economic strain weakened Rome’s stability and resource distribution. The empire, already struggling with internal and external pressures, found itself further destabilized. The Grain Tax was a symptom of larger systemic issues that contributed to the empire’s decline and eventual collapse.

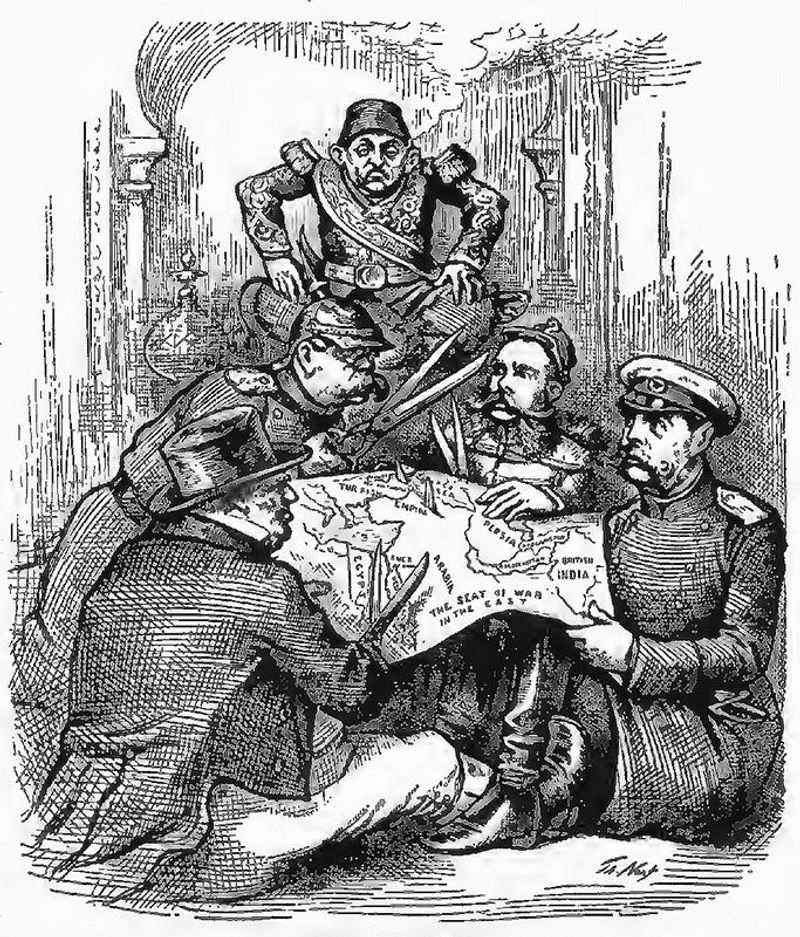

10. Tax Farming – Ottoman Empire

In the Ottoman Empire, tax farming was a practice that sowed seeds of discontent. Officials were allowed to collect taxes and keep the surplus, leading to rampant corruption and exploitation. This system wasn’t just a financial burden; it undermined trust in the government. As resentment grew, so did the calls for reform and revolt. The uprisings that followed weren’t solely about money; they were about justice and fairness. Tax farming eroded the stability of the empire over time, illustrating the detrimental effects of unchecked power and greed.

11. Chin Tax – Nigeria (early 1900s)

The Chin Tax in early 1900s Nigeria wasn’t just an economic levy; it was a spark for women’s empowerment and resistance. Imposed by British colonial rulers, this tax led to the Women’s War of 1929, one of Africa’s significant uprisings. Women from southeastern Nigeria organized protests, rejecting not just the tax but colonial rule. Their courage and determination highlighted the power of collective action. The Women’s War wasn’t just about taxes; it was about asserting identity and rights. This movement left a lasting legacy in Nigerian history.

12. Bagauda Tax Revolt – West Africa (1905)

In 1905, the Bagauda Tax Revolt in Nigeria was more than just a backlash against increased taxation by British colonial authorities. It was an assertion of dignity and self-determination. As taxes rose, so did the anger and resistance of the local population. This early African resistance was a precursor to the larger struggles for independence that would follow. The revolt was not solely about the immediate financial strain but about challenging the very nature of colonial exploitation and control. It set the stage for future liberation movements.

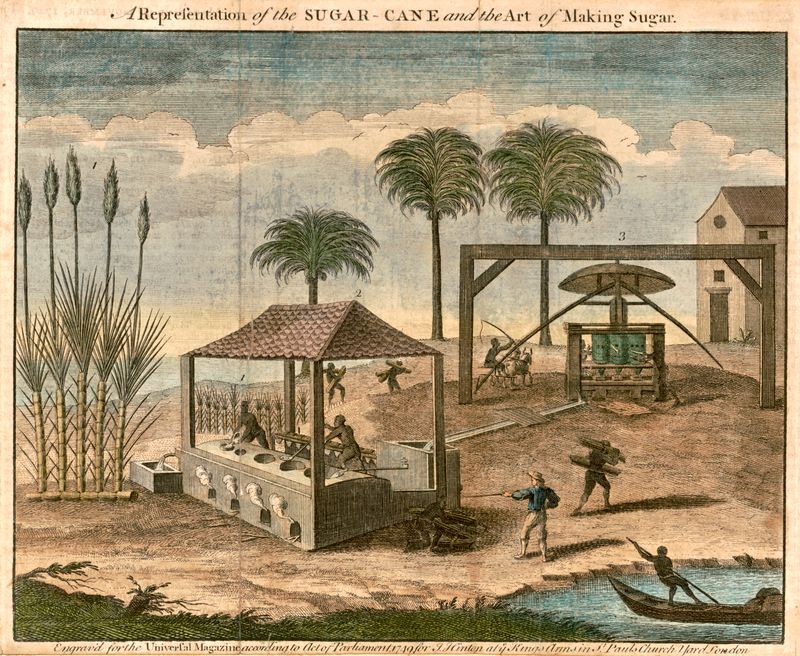

13. Sugar Act – Pre-American Revolution

The Sugar Act of 1764 wasn’t just a tax on molasses; it was a statement of imperial power. By tightening enforcement on sugar imports, Britain sought to strengthen its grip on colonial trade. The colonists, however, saw it as an infringement on their economic freedom. Protests and boycotts erupted, setting the stage for a broader resistance. This act was a critical moment in the prelude to the American Revolution. The Sugar Act represented more than just financial imposition; it was a challenge to the autonomy and rights of the colonies.

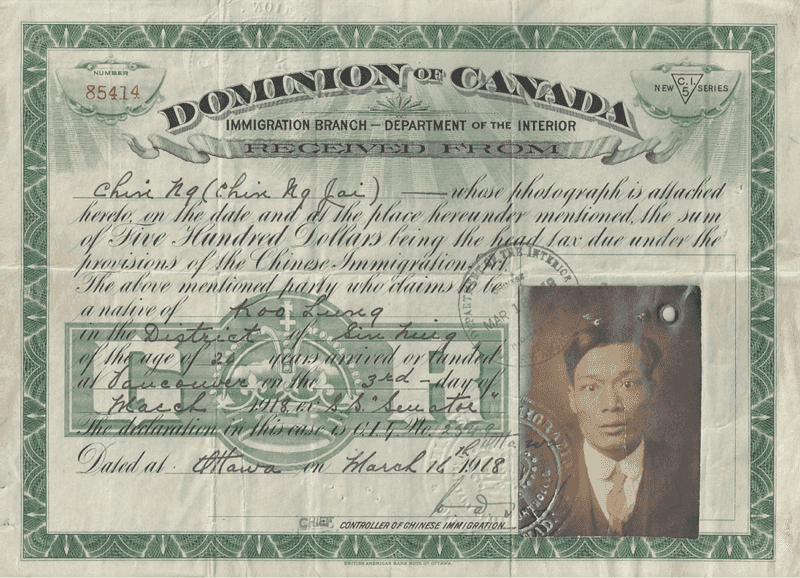

14. Head Tax – Chinese Immigrants in Canada

The Head Tax on Chinese immigrants in Canada was more than a financial burden; it was a symbol of systemic discrimination. Introduced in the late 19th century, this tax was designed to limit Chinese immigration. It caused significant hardship and separation for families. The tax sparked outcry and highlighted the broader issues of racial inequality and injustice. Over time, it led to demands for redress and apology. The Head Tax wasn’t just about money; it was about human dignity and the right to belong. It remains a poignant chapter in Canadian history.

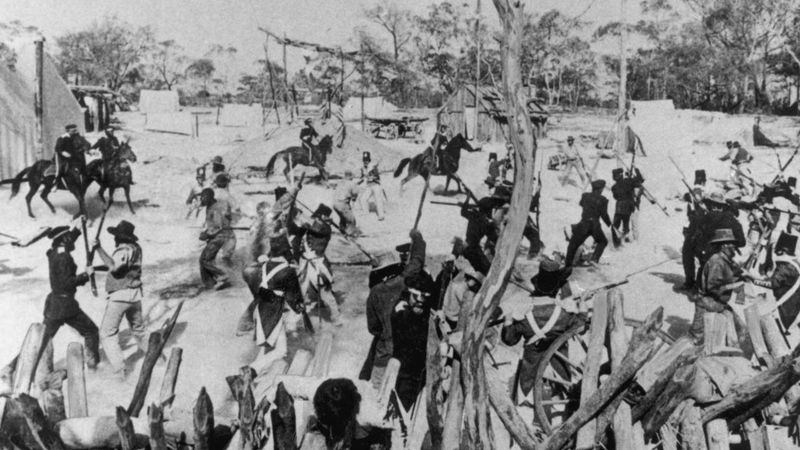

15. Stamp Duty – Australia’s Eureka Rebellion

Australia’s Eureka Rebellion was more than just a miners’ protest; it was a stand for justice and democracy. In 1854, miners in Ballarat, Victoria, were outraged by the oppressive stamp duty on mining licenses. Tensions erupted into violence at the Eureka Stockade, where miners clashed with authorities. The rebellion wasn’t solely about taxes but about broader rights and representation. This uprising was a pivotal moment in Australia’s democratic development. It symbolized the struggle for fair governance and the birth of a national identity rooted in egalitarian values.

16. Taxation Under King Charles I – English Civil War

King Charles I’s taxation policies were more than just fiscal measures; they were seeds of rebellion. By imposing taxes without Parliament’s consent, Charles provoked widespread outrage. His determination to finance his rule independently fueled tensions that erupted into the English Civil War. The war wasn’t merely about taxes; it was about authority and governance. Charles’s eventual execution marked a shift in England’s power dynamics. His taxation approach highlighted the dangers of absolute rule and the importance of checks and balances. It was a defining moment in shaping constitutional monarchy.

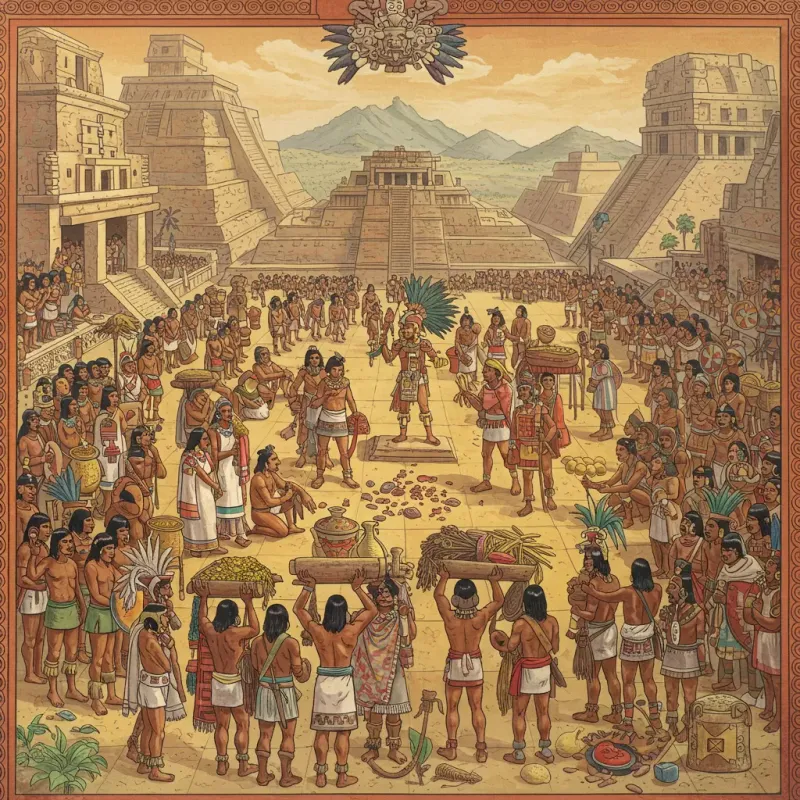

17. Tribute Taxes – Aztec Empire

The Aztec Empire’s tribute system was more than just an economic structure; it was a source of unrest and rebellion. Conquered peoples were required to pay high tribute taxes in goods, fueling resentment and resistance. This system, while initially strengthening the empire, eventually sowed division. The Spanish conquerors capitalized on this discontent, forming alliances with subjugated groups. The tribute taxes weren’t just about economic strain; they were about power and control. The exploitation and inequity inherent in the system contributed to the empire’s downfall, illustrating the fragility of oppressive rule.