Homeownership has long been viewed as a cornerstone of the American Dream, offering a suite of benefits that many younger generations today find contentious.

As property values soar and economic disparities widen, questions arise about whether these homeowner privileges are a symbol of earned success or mere greed.

This blog explores 21 specific homeowner privileges that younger generations are challenging, shedding light on the debate over whether these rights should be preserved or revoked.

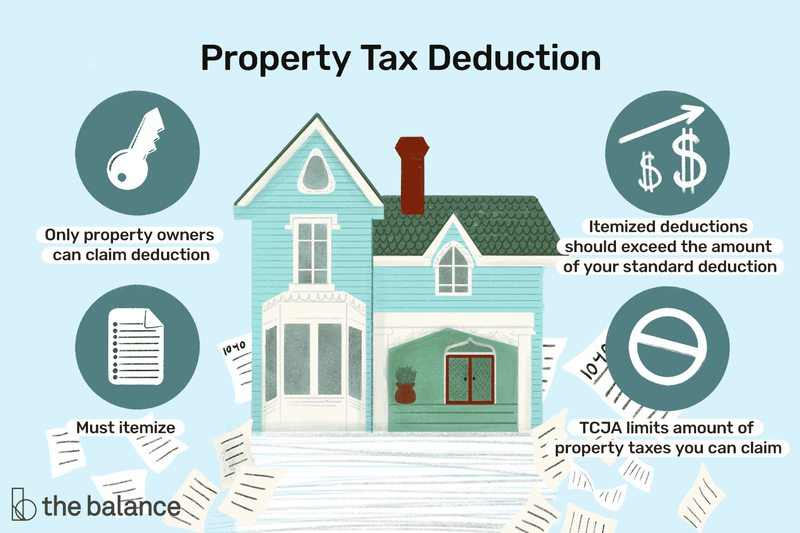

1. Property Tax Deductions

Property tax deductions have been a longstanding benefit for homeowners, allowing them to deduct local property taxes from their federal taxable income. This privilege is seen as a way to lessen the financial burden of owning a home. However, younger generations argue that it disproportionately favors wealthier individuals who own more expensive properties.

They feel that this deduction should be limited or eliminated to create a fairer tax system. By addressing these concerns, policymakers can create a more equitable landscape. The debate continues as to whether this is an earned right or an outdated benefit.

2. Mortgage Interest Deductions

Mortgage interest deductions allow homeowners to deduct interest paid on their home loans from taxable income. This can result in significant savings, especially for those with large mortgages. Critics argue that it encourages borrowing and inflates housing prices, making homes less affordable for first-time buyers.

Younger generations are calling for a reevaluation of this policy, seeking a more balanced approach. They suggest capping the deduction to prevent abuse. This could lead to more affordable housing options. The challenge is to find a solution that maintains fairness without stifling the housing market.

3. Homeownership Subsidies

Homeownership subsidies are designed to assist individuals in purchasing homes, often through government grants or reduced mortgage rates. While intended to support low-income families, critics claim these subsidies often benefit those who are already in a better position to buy.

Younger generations are pushing for reforms to ensure that these subsidies reach those truly in need. They propose more stringent eligibility requirements. Such changes aim to level the playing field and promote genuine opportunities for homeownership. Balancing assistance with equity is key to addressing these concerns.

4. Exemption from Rent Control

Exemption from rent control allows homeowners to adjust rental prices without government restrictions, often leading to increased rents in desirable areas. Younger generations argue that this privilege contributes to housing inequality, making it challenging for renters to find affordable options.

They advocate for policies that extend rent control protections to more properties, including those owned by non-resident landlords. By doing so, they hope to create a more balanced rental market. The goal is to provide stability and fairness for all tenants, regardless of their housing status.

5. Rising Property Values

Rising property values can significantly increase a homeowner’s wealth, providing financial security and opportunities for investment. However, younger generations feel that this privilege widens the wealth gap, making it harder for them to enter the market.

They suggest implementing measures to stabilize property prices, such as regulating speculative investments. This could help make housing more accessible for everyone. The challenge lies in balancing market dynamics with the need for affordable housing. It’s a complex issue with no simple solutions, but it’s crucial to explore these possibilities.

6. Unlimited Tax-Free Capital Gains

Unlimited tax-free capital gains offer homeowners the advantage of selling their primary residence without paying taxes on the profit. While this can be a substantial financial boon, younger generations view it as an unfair advantage that benefits those already in a strong financial position.

They argue for limits on this exemption to ensure a more equitable distribution of wealth. Implementing caps or restrictions could prevent excessive profiteering and promote fairer opportunities for all. The conversation around this topic continues to evolve as more voices join the debate.

7. Inheritance of Property

Inheritance of property allows family homes to be passed down without significant tax burdens, preserving wealth through generations. Younger individuals argue that this privilege perpetuates inequality, keeping valuable properties within certain families while excluding others.

They call for reforms to inheritance tax laws to ensure a more equitable distribution of property. By addressing these concerns, there’s potential to create a fairer landscape for future homeowners. The debate is complex and emotionally charged, as it involves family legacies and financial security.

8. Zoning Privileges

Zoning privileges allow homeowners to influence local development, often resulting in restrictive laws that limit affordable housing construction. Younger generations feel that these privileges protect homeowners’ interests at the expense of broader community needs.

They seek to reform zoning laws to promote diverse and inclusive housing developments. By encouraging mixed-use and affordable housing, communities can become more dynamic and accessible. The challenge is to balance individual property rights with the need for inclusive community growth.

9. Exclusive Access to Home Equity Loans

Exclusive access to home equity loans allows homeowners to borrow against their property’s value, providing financial flexibility. While beneficial, younger generations argue that this privilege creates economic disparities, as renters do not have similar opportunities.

They propose expanding credit options for non-homeowners to ensure equitable access to financial resources. By leveling the playing field, individuals can have more control over their financial futures. The focus is on creating a system where everyone can thrive, regardless of their housing status.

10. Homeowner-Only Loan Rates

Homeowner-only loan rates offer favorable terms to those with home equity, making borrowing more affordable. Critics argue that this privilege excludes renters, perpetuating financial inequality.

Younger generations call for equal access to competitive loan rates, regardless of homeownership status. By addressing these concerns, the financial system can become more inclusive and fair. The aim is to unlock opportunities for all, ensuring that everyone has the chance to achieve their financial goals. It’s a conversation about fairness and accessibility in the lending landscape.

11. No Rent or Tenant Protection Laws

The absence of rent or tenant protection laws for homeowners means they are not subject to the same regulations as landlords, allowing them to set their own rules. Younger generations argue that this lack of oversight can lead to exploitation and unfair practices.

They advocate for extending tenant protection laws to cover more housing situations, ensuring fairness for all. By implementing these protections, the housing market can become more balanced and just. It’s about creating a system where everyone is treated equitably, fostering trust and stability.

12. Owner-Occupied Benefits

Owner-occupied benefits provide tax advantages and incentives for those living in their homes, encouraging homeownership. Younger generations view these benefits as unfair, as they often exclude renters who contribute significantly to the community.

They propose reevaluating these policies to ensure fairness for all residents, regardless of homeownership. By addressing these discrepancies, a more equitable community can be fostered. The focus is on inclusivity and recognizing the contributions of all residents. This is a call for policy changes that reflect modern housing realities.

13. Automatic Property Value Increase

Automatic property value increases can significantly enrich homeowners, as their property appreciates without additional investment. However, younger generations argue that this privilege exacerbates economic disparity, as wealth accumulates for property owners at the expense of others.

They suggest implementing policies to regulate excessive property value increases, creating a more balanced housing market. The aim is to make homeownership achievable for all, not just the fortunate few. It’s about finding solutions that promote fairness and accessibility in the housing sector.

14. Rights to Rent Out Entire Property

The right to rent out an entire property allows homeowners to generate income, often through platforms like Airbnb. Younger generations argue that this privilege contributes to housing shortages and drives up rental prices in popular areas.

They call for regulations that balance homeowners’ rights with community needs, ensuring housing remains accessible to locals. By addressing these concerns, the focus is on creating vibrant communities where everyone can thrive. It’s about responsible property management and prioritizing community well-being over profits.

15. Access to Property Appreciation

Access to property appreciation offers homeowners the chance to build wealth over time as their property increases in value. Younger generations feel this privilege contributes to economic inequality, as renters are unable to benefit similarly.

They propose creating opportunities for non-homeowners to participate in property-related investments. This could level the economic playing field, offering everyone a chance to build wealth. The focus is on innovative solutions that address disparities and promote inclusivity in wealth-building opportunities.

16. Preferential Treatment in Loan Approvals

Homeowners often receive preferential treatment in loan approvals, benefiting from their equity and perceived stability. Younger generations argue that this creates an uneven financial landscape, where renters face more challenges in securing loans.

They call for fair lending practices that prioritize an individual’s financial health over ownership status. By addressing these concerns, the financial industry can become more inclusive and just. The goal is to ensure that everyone has equal access to financial resources, fostering a more equitable economic environment.

17. Ability to Pass Properties to Heirs Without Tax

The ability to pass properties to heirs without tax burdens enables families to preserve wealth across generations. Younger generations argue that this privilege perpetuates economic inequality, limiting opportunities for others.

They advocate for reforms to inheritance tax laws to ensure a fairer distribution of wealth. By addressing these issues, there’s potential for a more equitable society. It’s a challenging discussion, balancing family rights with societal needs. The focus is on creating policies that reflect a commitment to fairness and opportunity for all.

18. Special Subsidies for First-Time Homebuyers

Special subsidies for first-time homebuyers are intended to make homeownership accessible to those entering the market. While beneficial, critics argue that these subsidies can inflate prices and put pressure on housing supply.

Younger generations propose reevaluating how these subsidies are distributed to ensure they effectively aid those in need. By refining these programs, the aim is to support genuine affordability. The conversation focuses on making the dream of homeownership achievable for everyone, without unintended market consequences.

19. Eviction Protections

Eviction protections provide homeowners with safeguards against losing their property due to financial hardships. Younger generations argue that similar protections should be extended to renters, who often face housing instability.

They call for policies that ensure housing security for all, regardless of ownership. By implementing these protections, communities can foster stability and trust. The focus is on creating a housing market where everyone feels secure and valued, promoting a sense of community and belonging.

20. Homeowner-Only Public Infrastructure Upgrades

Homeowner-only public infrastructure upgrades often prioritize areas with higher ownership rates, leading to disparities in community investment. Younger generations argue that these upgrades should be equitably distributed to benefit all residents.

They call for a more inclusive approach to infrastructure spending, ensuring that all communities thrive. By addressing these concerns, the focus is on building a fairer and more connected society. It’s about recognizing the needs of all residents and promoting equitable development.

21. State-Sponsored Assistance for Home Improvements

State-sponsored assistance for home improvements provides homeowners with financial support to enhance their properties. Younger generations argue that equivalent programs should be available to renters, allowing them to improve their living spaces.

They propose expanding these benefits to ensure fairness and inclusivity. By addressing these concerns, the focus is on creating a housing market that values all residents equally. It’s about fostering community investment and ensuring everyone can enjoy a high quality of life.