Retirement is a phase that many look forward to, promising relaxation and the freedom to pursue hobbies and spend time with loved ones.

However, misconceptions abound, especially among the baby boomer generation, potentially jeopardizing their financial security and peace of mind during these years.

This blog post delves into 21 prevalent myths about retirement that financial experts wish would fade away.

By debunking these myths, we aim to provide a clearer understanding of retirement planning and help ensure a more secure and enjoyable retirement experience.

1. Social Security Will Cover Everything

Many baby boomers believe that Social Security benefits will entirely cover their living expenses in retirement. However, this misconception can lead to financial strain. Social Security is designed to supplement, not replace, retirement income.

Typically, it covers about 40% of pre-retirement income. Relying solely on it might leave retirees struggling to maintain their lifestyle. It’s crucial to have additional savings, investments, or a pension plan to support the remaining expenses.

A diversified retirement portfolio ensures a more comfortable and secure retirement, reducing the reliance on Social Security alone.

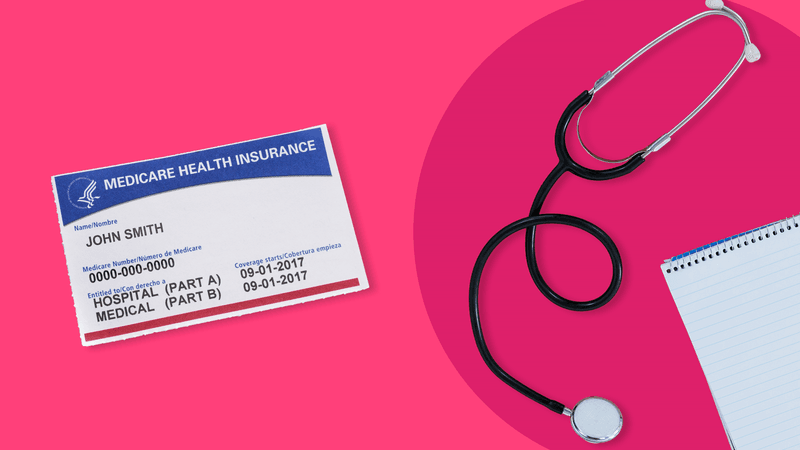

2. Medicare Covers All Healthcare Costs

Believing that Medicare will cover all healthcare costs is a common myth. While Medicare provides essential coverage, it doesn’t cover everything.

Costs like dental, vision, and long-term care often require additional insurance or out-of-pocket payments. These expenses can accumulate, potentially burdening those unprepared.

Retirees should plan for these extra costs by considering supplemental insurance policies. Understanding Medicare’s limitations helps in making informed decisions, ensuring comprehensive healthcare without unexpected financial stress.

Proper planning includes evaluating healthcare needs and exploring options beyond Medicare for a worry-free retirement.

3. Retirement Means Complete Leisure

The idea of endless leisure in retirement might sound appealing, but it’s not always the reality. Many retirees find themselves bored without the structure of work. Engaging in hobbies, part-time work, or volunteering can provide purpose and fulfillment.

Retirement should be about balance, not just leisure. Planning for activities that stimulate both mind and body is essential.

Staying active and involved can lead to a more satisfying retirement experience. It’s important to redefine retirement as a phase of active engagement rather than mere rest.

4. Downsizing Always Saves Money

Downsizing to save money is a common strategy, yet it doesn’t always guarantee savings. Hidden costs like moving expenses, renovations, or higher property taxes can negate expected savings.

Additionally, emotional attachment to a long-term home can complicate the decision. Thorough research and planning are necessary before downsizing. Evaluating all potential costs and benefits helps retirees make informed choices.

Sometimes, staying put might be more financially viable. A well-thought-out decision ensures that downsizing contributes positively to financial stability rather than causing unexpected financial burdens.

5. You’ll Spend Much Less in Retirement

Expecting to spend significantly less in retirement is a misconception. While work-related costs may decrease, healthcare, leisure, and unexpected expenses can rise.

Many retirees find their spending habits remain stable or even increase as they pursue interests and travel. Budgeting accurately for retirement involves considering lifestyle goals and potential healthcare needs.

Understanding actual spending patterns helps in avoiding financial shortfalls. Planning for a realistic retirement budget supports financial security and allows retirees to enjoy their desired lifestyle without monetary constraints.

6. You Can Work Indefinitely

While many plan to work indefinitely, health issues or job market changes can disrupt these intentions. Relying on continuous employment in retirement isn’t always feasible. Preparing for the possibility of reduced work capacity is crucial.

Building a robust retirement savings plan ensures financial security, even if work becomes unmanageable. Exploring part-time or flexible work options can offer a balance between earning and relaxation.

Being adaptable to changes in work capability is essential for a stable and enjoyable retirement. Planning ahead mitigates the risks of unforeseen work disruptions.

7. Investments Are Too Risky

Fear of investment risks leads some to avoid stocks or other opportunities. However, overly conservative strategies may not yield sufficient growth to support long-term retirement needs.

Understanding and managing investment risks through diversification can enhance returns while minimizing potential losses. Financial advisors can provide guidance tailored to individual risk tolerance and goals.

It’s important to find a balance between risk and reward to ensure the longevity of retirement funds. Educating oneself about investment options can lead to informed decisions and a more secure financial future.

8. Pensions Are Guaranteed

Assuming pensions are entirely secure is a widespread myth. Economic downturns or company bankruptcies can threaten pension viability. It’s vital to understand the terms and conditions of a pension plan.

Diversifying retirement savings beyond a single pension source is advisable. Exploring additional savings and investment options can provide a safety net. Staying informed about pension security ensures preparedness for any potential changes.

A well-rounded financial plan includes contingency measures to safeguard against unexpected pension issues. Proactive management of pension expectations is key to financial stability.

9. Retirement Planning Can Wait

Many delay retirement planning, thinking they have ample time. However, early planning is crucial for maximizing savings and minimizing stress. The power of compound interest and long-term investments can significantly boost retirement funds.

Starting early allows for more flexibility and adaptability in financial strategies. Regularly reviewing and adjusting plans ensures alignment with evolving goals and circumstances.

Procrastination can lead to financial insecurity and missed opportunities. Prioritizing retirement planning from an early age is essential for a comfortable and secure retirement. Early action facilitates a well-prepared financial future.

10. Debt-Free Before Retirement

The notion that one must be completely debt-free before retiring is a common belief. While reducing debt is beneficial, it’s not always necessary to eliminate it entirely.

Managing debt through strategic payment plans ensures it doesn’t detract from retirement enjoyment. Assessing interest rates and prioritizing high-interest debts is key.

Some retirees choose to retain low-interest debt to free up capital for other investments. Balancing debt management with savings goals creates a financially sound retirement plan.

Understanding personal financial situations helps retirees make informed decisions about debt.

11. You Can Rely on Family for Support

Relying on family for financial or emotional support is often anticipated, but it may not be realistic. Family dynamics and circumstances can change, impacting the ability or willingness to offer support.

Planning for independence allows for a more stable and dignified retirement. While family can be a source of love and companionship, financial decisions should not rely solely on their support.

Building a retirement plan that includes savings and insurance ensures self-sufficiency. Understanding the limitations of family support is essential for a secure retirement.

12. All Expenses Will Decrease

The myth that all expenses will decrease in retirement is misleading. Although some costs, like commuting, might reduce, others like healthcare and leisure can increase.

Many retirees find themselves spending more on travel, hobbies, or healthcare than anticipated. Proper budgeting requires a realistic view of expected expenses. Understanding lifestyle changes and potential costs helps in crafting a comprehensive financial plan.

Planning for both predictable and unforeseen expenses ensures a financially comfortable retirement. Expecting a reduction in all costs can lead to financial challenges without adequate preparation.

13. You Can Withdraw 4% Safely

The 4% rule, popular among retirees, suggests withdrawing 4% annually from savings to avoid depleting funds. However, market fluctuations and personal circumstances can affect its suitability.

Rigid adherence to this rule might not align with individual financial situations. Regularly reviewing withdrawal strategies with financial advisors ensures they meet current needs and market conditions.

Flexibility in withdrawal plans helps accommodate changes in expenses or income sources. Understanding the nuances of withdrawal rates promotes financial longevity and security.

Adapting strategies to suit personal circumstances ensures sustainable retirement funds.

14. A Set Retirement Date

Believing in a fixed retirement date can be limiting. Life events, health, or financial readiness can affect the timing. Flexibility in retirement planning allows adaptation to personal or economic changes.

Regularly reassessing retirement goals and timelines ensures they align with current situations. Being open to adjusting retirement dates can provide more security and satisfaction.

Planning should account for uncertainties, offering alternatives if needed. Embracing flexibility in retirement timing encourages a smoother transition and better preparedness. A fluid approach to retirement planning enhances overall financial stability.

15. Your Home is a Retirement Asset

Viewing a home primarily as a retirement asset is a common misconception. While real estate can contribute to financial security, it shouldn’t be the sole reliance. Market volatility or emotional attachment can complicate selling decisions.

Diversifying assets prevents over-reliance on real estate. Exploring options like reverse mortgages might provide additional income while retaining ownership. Understanding the role of a home in a broader financial plan ensures better decision-making.

Balancing real estate with other investments contributes to a well-rounded retirement strategy. Wise asset management promotes financial resilience.

16. Living Expenses Will Stay the Same

The belief that living expenses remain unchanged is misleading. Inflation and lifestyle changes can increase costs over time. Many retirees underestimate future expenses, leading to financial strain.

Planning should incorporate potential cost increases and lifestyle adjustments. Regularly updating budgets to reflect changes ensures alignment with financial realities.

Understanding the impact of inflation and evolving needs helps maintain financial stability.

Preparing for fluctuating expenses allows retirees to enjoy their lifestyle without financial anxiety. Realistic budgeting and ongoing assessments are key to a secure and adaptable retirement.

17. Retirement Equals Idleness

Perceiving retirement as a time of idleness can lead to dissatisfaction. Many find fulfillment in pursuing passions, volunteering, or part-time work. Engaging in meaningful activities promotes mental and physical well-being.

Retirement offers opportunities to explore interests and contribute to the community. Planning for an active lifestyle ensures a more rewarding retirement experience. Balancing relaxation with purposeful activities fosters a sense of accomplishment and joy.

Embracing an active retirement lifestyle encourages personal growth and satisfaction. Retirement is a time to redefine identity and pursue lifelong interests passionately.

18. You Won’t Need Life Insurance

Assuming life insurance is unnecessary in retirement overlooks potential benefits. It can provide financial security for spouses or cover estate taxes. Evaluating personal circumstances and family needs determines its relevance.

Life insurance may offer peace of mind, knowing loved ones are protected. Consulting with financial advisors helps assess coverage suitability. Balancing insurance with other retirement plans ensures comprehensive financial protection.

Understanding the role of life insurance in retirement planning avoids gaps in financial security. Tailored insurance solutions align with individual goals and family dynamics.

19. Estate Planning Isn’t Necessary

Neglecting estate planning is a misconception that can lead to unresolved affairs. Proper planning ensures assets are distributed according to wishes, minimizing family disputes.

Estate planning encompasses wills, trusts, and healthcare directives. Consulting legal professionals provides clarity and ensures compliance with regulations. Early planning allows for revisions as circumstances change.

Comprehensive estate arrangements offer peace of mind for retirees and their families. Understanding the importance of estate planning avoids potential complications. A well-structured estate plan secures the legacy and simplifies transitions for loved ones.

20. Retirement Funds Shouldn’t Be Touched

The idea of never touching retirement funds is unrealistic. Strategic withdrawals are essential for managing living expenses. Withdrawal timing and amounts should align with financial goals and market conditions.

Consulting financial advisors ensures withdrawals support long-term stability. Understanding required minimum distributions and tax implications helps optimize fund usage.

Balancing withdrawals with other income sources promotes financial longevity. Proper management of retirement funds enhances financial security and lifestyle enjoyment.

Adapting withdrawal strategies to personal circumstances ensures funds serve their intended purpose effectively.

21. Retirement Is the End of Learning

Believing retirement marks the end of learning ignores opportunities for personal growth. Many retirees find joy in pursuing education, whether formal or informal. Lifelong learning stimulates mental acuity and opens new horizons.

Community classes, online courses, or hobbies provide avenues for exploration. Embracing continuous learning enriches retirement life and fosters a sense of accomplishment.

Planning an educational journey keeps the mind engaged and curious. Retirement is a chance to delve into interests previously unexplored. An active pursuit of knowledge enhances overall well-being and satisfaction.