Navigating the world of Social Security can be overwhelming, especially with so many myths that could mislead you. Understanding these myths is crucial for anyone planning a secure retirement.

Here, we explore 21 common myths, challenging their validity and providing clarity on each. Agree or disagree, this guide seeks to equip you with factual knowledge that could protect your financial future.

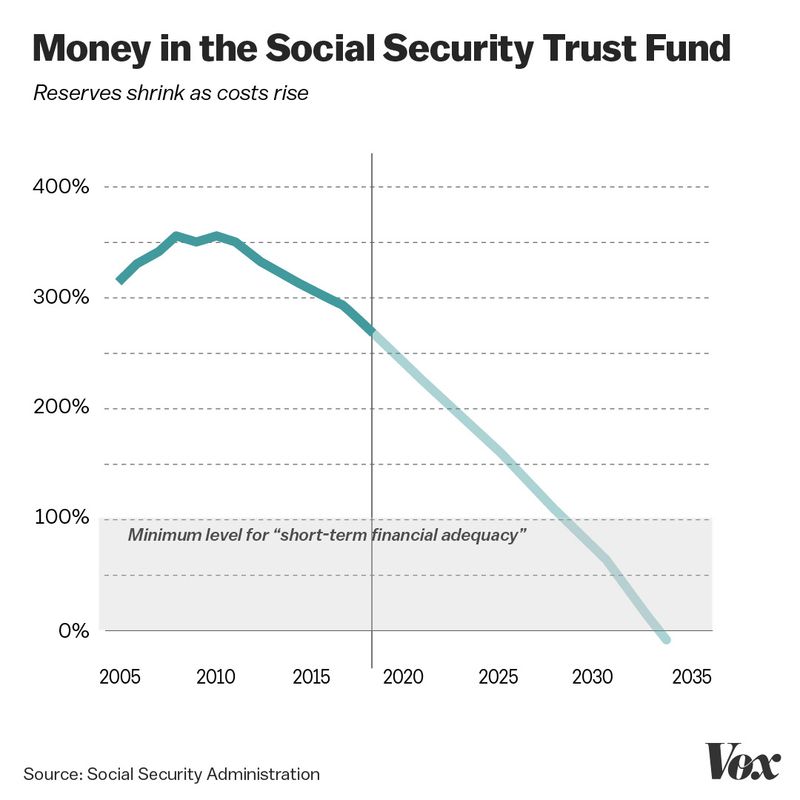

1. Myth 1: Social Security Will Run Out Soon

Many believe that Social Security is on the brink of collapse. While funds are projected to be depleted by 2034, taxes will still cover about 78% of benefits.

It’s crucial for individuals to plan supplemental retirement savings to cover any potential shortfall. This myth creates unnecessary panic, obscuring the need for strategic financial planning.

Recognizing the importance of diversified income streams can alleviate fears about the system’s uncertainty, ensuring a more stable retirement.

2. Myth 2: You Can’t Work and Receive Benefits

Many retirees assume that starting work will automatically disqualify them from receiving Social Security benefits. In reality, you can still earn wages and receive benefits.

However, surpassing the annual earnings limit might temporarily reduce your benefit amount. Thus, balancing work and benefits is essential for maximizing income.

Understanding how the earnings test works can help retirees make informed decisions about employment and retirement benefits, ensuring a financially secure lifestyle.

3. Myth 3: Benefits Are Tax-Free

A common misconception is that Social Security benefits are exempt from taxes. In truth, they can be taxable depending on your income bracket.

Up to 85% of your benefits might be subject to federal taxes if your income exceeds certain thresholds. Recognizing this can help you plan your tax liabilities.

Preparing for potential taxes ensures that you can manage your finances effectively, avoiding unpleasant surprises during tax season.

4. Myth 4: Benefits Automatically Start at 65

Some believe benefits automatically commence at age 65, but that’s not the case. Full retirement age varies, often beyond 65, depending on your birth year.

Delaying benefits can increase your monthly payments, offering more financial flexibility later in retirement.

Knowing the right time to claim benefits is vital to maximizing your Social Security income, providing enhanced financial stability throughout your retirement years.

5. Myth 5: Social Security is Only for Retirees

Many perceive Social Security as a retirement-only program. In reality, it provides crucial support for disabled individuals, survivors, and dependents.

Understanding this broader scope can help you or your family access benefits if needed. Misunderstanding the program’s reach often leads to lost opportunities for assistance.

Recognizing the full range of beneficiaries enhances awareness and planning, ensuring that eligible parties can access necessary resources.

6. Myth 6: Spousal Benefits are Automatic

Many assume spousal benefits are automatic upon marriage, but specific eligibility criteria must be met.

You may receive up to 50% of your spouse’s benefit if you meet conditions like age and marital duration. This requires careful consideration and planning.

Understanding these conditions helps you make informed decisions regarding benefit claims, optimizing joint retirement resources and ensuring financial well-being for both partners.

7. Myth 7: You Don’t Need to Check Your Earnings Record

Some believe that their Social Security earnings record is always accurate, negating the need for review. However, errors can occur, affecting your future benefits.

Regularly checking your record ensures it reflects your true earnings, safeguarding your future income.

Taking the time to verify your earnings can prevent discrepancies and ensure you receive the full benefits you deserve, securing your financial future.

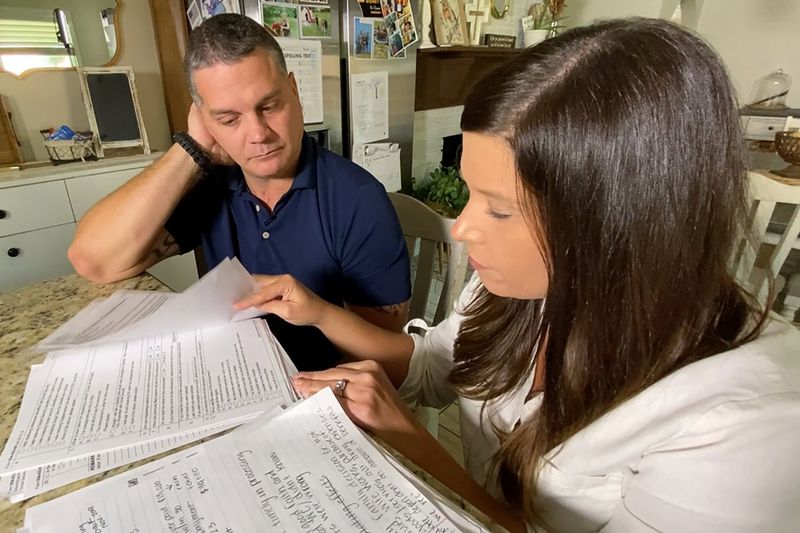

8. Myth 8: You Can Live Comfortably on Social Security Alone

The belief that Social Security alone is sufficient for a comfortable retirement is misleading. Benefits typically replace only about 40% of pre-retirement income.

Additional savings and income sources are crucial for maintaining your lifestyle. Over-reliance can lead to financial strain.

Planning a diversified retirement strategy ensures you have ample resources to enjoy a fulfilling retirement, free from financial stress.

9. Myth 9: Benefits Increase Automatically with Inflation

While Social Security benefits do adjust for inflation through COLAs, these increases may not fully match inflation rates.

The cost of living adjustments can lag behind actual inflation, impacting purchasing power. Understanding this helps manage expectations regarding benefits.

Being aware of these limitations allows for better financial planning, ensuring that your retirement funds remain robust and effective against inflationary pressures.

10. Myth 10: You Should Claim Benefits As Early As Possible

Claiming benefits at the earliest eligibility is tempting, yet it might not always be beneficial. Early claims permanently reduce monthly payouts.

Delaying can significantly increase benefits, offering greater long-term gains. Assessing your financial situation is vital before making this decision.

Weighing the pros and cons of early versus delayed claims can optimize your retirement strategy, ensuring financial security for the years ahead.

11. Myth 11: You Lose Benefits If Divorced

Divorce doesn’t automatically disqualify you from receiving benefits. If the marriage lasted at least 10 years, you could still be eligible for spousal benefits.

This provides financial support even post-divorce, offering a safety net. Knowing this can ease post-divorce financial concerns.

Understanding your rights ensures that you maintain access to benefits, helping stabilize your financial status during life changes.

12. Myth 12: Your Social Security Number Is Secure

Many believe their Social Security number is safe from theft, but this is a growing concern. Identity theft can lead to financial loss and personal stress.

Protecting your information is crucial. Be vigilant about sharing your number and monitor your accounts frequently.

Ensuring robust security measures can help safeguard your identity, preventing unauthorized access and ensuring peace of mind.

13. Myth 13: Married Couples Get Double Benefits

There’s a misconception that married couples receive double benefits, which isn’t accurate. Benefits are based on individual earnings records.

While spousal benefits exist, they depend on each partner’s work history and earnings. Understanding this prevents unrealistic financial planning.

Clarifying benefit calculations can help couples plan effectively, ensuring realistic expectations and better financial management in retirement.

14. Myth 14: Social Security Drains the Economy

Some argue that Social Security burdens the economy, but it also stimulates economic activity. Benefits support consumer spending, contributing to economic health.

This myth disregards the positive impact Social Security has through boosting local economies and supporting small businesses.

Recognizing the program’s broader economic role helps counter misconceptions, fostering a balanced view of its effects.

15. Myth 15: Social Security Benefits Are the Same for Everyone

Not all receive identical benefits; they’re calculated based on earnings history and the age at which you claim. This variability highlights the need for personalized planning.

Understanding your specific situation ensures you maximize your benefits, aligning them with your financial goals.

Recognizing benefit variability helps tailor your retirement strategy, ensuring it meets your unique needs and circumstances.

16. Myth 16: You Can Rely Solely on Social Security Advisors

While Social Security advisors provide valuable guidance, relying exclusively on them can lead to gaps in your financial planning.

Advisors might not always address personal financial goals or situations. Diversifying your advice sources enhances retirement strategy.

Seeking broader financial expertise ensures comprehensive planning, integrating Social Security with other financial elements for optimal retirement outcomes.

17. Myth 17: You Can’t Change Benefit Decisions

It’s believed that Social Security decisions are final, but there are options for adjustments. Within 12 months of claiming, you can withdraw your application and repay benefits.

Additionally, if you reach full retirement age, benefits can be suspended to increase future payments.

Knowing these options provides flexibility, allowing you to adapt your strategy as needed to maximize benefits and financial security.

18. Myth 18: Full Retirement Age is Fixed

Full retirement age isn’t fixed; it varies based on your birth year. Understanding this ensures you plan appropriately for maximum benefits.

Recognizing the nuances of retirement age helps align your retirement planning with your personal timeline.

This knowledge empowers you to make informed decisions, optimizing your retirement benefits and achieving financial stability.

19. Myth 19: Social Security is Free Money

Many view Social Security as free money, forgetting contributions made through payroll taxes during their working years.

Understanding this helps manage expectations and value the benefits received.

Acknowledging the cost associated with benefits fosters a realistic approach to planning, optimizing resource allocation for retirement needs.

20. Myth 20: You Have No Control Over Your Benefits

Contrary to belief, you can manage aspects of your Social Security benefits through informed decisions on when to claim and how earnings affect payouts.

Taking control of these variables ensures you optimize your benefits, aligning them with your financial goals.

Empowering yourself with knowledge enhances your retirement strategy, ensuring your benefits serve your best interests effectively.

21. Myth 21: Social Security Covers All Healthcare Costs

Many believe Social Security covers healthcare, but it doesn’t. Medicare helps but isn’t comprehensive. Out-of-pocket expenses can be significant.

Planning for healthcare costs is crucial for a secure retirement. Understanding this myth prevents financial hardship.

Preparing for potential medical expenses ensures a stable financial foundation, allowing you to manage healthcare needs without financial stress.