Money management looks different for millennials than it did for previous generations. Born into a world of rapid technological change, economic uncertainty, and shifting values, millennials have developed unique financial strategies.

These money habits aren’t just personal choices—they’re reshaping how society thinks about wealth, work, and financial success.

1. Experiences Over Possessions

Concert tickets trump designer handbags in the millennial value system. Many young adults would rather spend on travel, festivals, and workshops than accumulate physical stuff.

This shift reflects a deeper understanding that memories create lasting happiness while material items often bring only temporary joy. Social media has amplified this trend, with experience-sharing becoming a form of social currency.

2. Remote Work Revolution

Goodbye cubicles, hello coffee shops! Millennials pioneered the work-from-anywhere movement long before it became mainstream. They seek jobs offering location flexibility, often prioritizing this over higher salaries at office-bound positions.

Remote work reduces commuting costs and allows living in more affordable areas. This approach transforms how money flows through their budgets, with less spent on work clothes and commuting, more on home offices and internet.

3. Crypto Curiosity

Bitcoin, Ethereum, and NFTs have captured millennial imagination like no previous investment vehicle. Many have embraced these digital assets despite their volatility, seeing them as both investment opportunities and technological revolution.

Unlike their parents who trusted traditional banking systems, millennials who came of age during the 2008 financial crisis often view cryptocurrency as a legitimate alternative. They’re more willing to allocate portions of their portfolios to these speculative but potentially revolutionary assets.

4. App-Based Money Management

Paper budgets are ancient history for the generation that grew up with smartphones. Millennials track spending, invest, and plan financial goals through sleek digital interfaces.

Apps like Mint, YNAB, and Acorns have transformed budgeting from a tedious chore into an engaging, gamified experience. This tech-forward approach makes financial management more accessible and transparent, helping many develop stronger saving habits than they might have with traditional methods.

5. Homeownership Hesitation

White picket fences aren’t topping millennial priority lists. Many are postponing home purchases until their 30s or 40s, if at all.

This isn’t just about avocado toast—it reflects rational responses to economic realities. Student loan burdens, rising housing costs, and career mobility needs make renting more practical for many. Rather than rushing into mortgages, they’re strategically waiting until their finances and lifestyles align with the commitment of homeownership.

6. Renting as a Lifestyle Choice

“Forever renters” isn’t an insult to many millennials—it’s a deliberate financial strategy. Renting provides flexibility to relocate for career opportunities without the burden of selling property.

Many see advantages in avoiding property taxes, maintenance costs, and being tied to a single location. Their parents viewed renting as throwing money away, but millennials often calculate that investing the difference between rent and ownership costs can yield better long-term returns, especially in expensive housing markets.

7. Work-Life Balance Premium

Six-figure salaries with 80-hour workweeks? Many millennials say no thanks. They’re often willing to earn less for jobs that respect their personal time and wellbeing.

Having watched parents sacrifice health and relationships for careers, this generation takes a more holistic view of success. Companies offering flexible schedules, remote options, and generous vacation policies often win talent over higher-paying competitors. This values shift fundamentally changes how millennials evaluate job offers and career paths.

8. Side Hustle Economy

Driving for Uber on weekends or selling handcrafts on Etsy isn’t just about extra cash—it’s financial insurance. Millennials pioneered the modern side hustle movement, creating income streams beyond their main jobs.

Economic instability taught this generation that relying on a single employer is risky. Their approach to earning reflects this reality. These supplementary gigs provide both additional income and skills development, creating safety nets that previous generations rarely needed to consider.

9. Conscious Consumption

Brand values matter as much as product quality to millennial shoppers. They research company ethics before making purchases, often paying premiums for sustainable, socially responsible options.

This generation views spending as voting with dollars. Environmental impact, labor practices, and corporate transparency influence their choices. While critics call this virtue signaling, it represents a fundamental shift in consumer power dynamics, forcing companies to improve practices to remain competitive in millennial markets.

10. Index Fund Enthusiasm

Forget stock picking—millennials love the simplicity of index funds. They’re embracing low-cost, diversified investment vehicles earlier than previous generations did.

Platforms like Vanguard and Betterment have made investing accessible without specialized knowledge. Many millennials start retirement accounts in their 20s, understanding compound interest’s power. This passive approach contradicts the active trading their parents often preferred, reflecting both technological changes and lessons learned from market crashes.

11. Traditional Career Skepticism

Lifetime employment at one company seems like ancient history to millennials. They question the security and value of traditional career paths their parents followed.

Witnessing corporate layoffs and economic downturns shaped this generation’s career outlook. Many prioritize skill development over company loyalty, changing jobs every few years. This approach often leads to higher lifetime earnings but requires different financial planning strategies to manage between-job transitions and variable income periods.

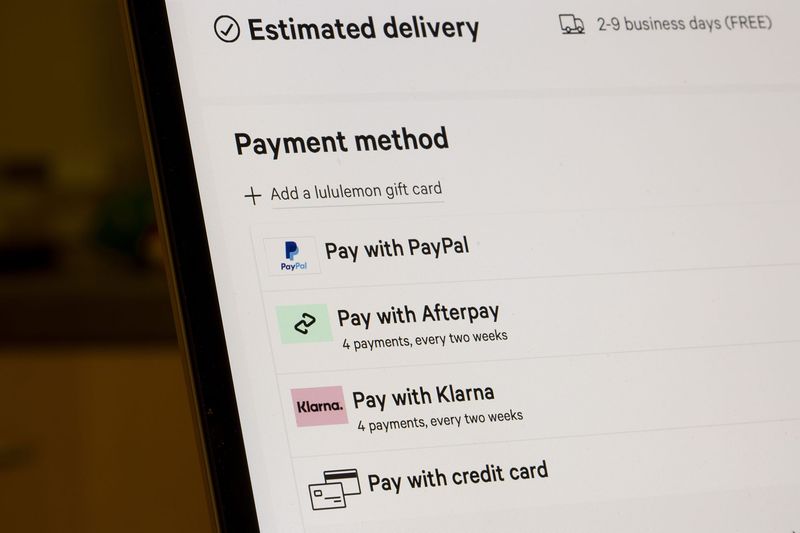

12. Buy-Now-Pay-Later Adoption

Services like Afterpay and Klarna have revolutionized how millennials approach purchases. These interest-free installment plans help manage cash flow without traditional credit card debt.

Used wisely, BNPL services allow for budgeting large expenses across paychecks. However, they also create new financial pitfalls. Many millennials use these tools to maintain spending power during economic uncertainty, representing a fundamental shift in how consumers finance purchases outside traditional banking systems.

13. Digital Banking Preference

Physical bank branches? Millennials rarely step inside them. Online-only banks like Chime and Ally have captured this generation with user-friendly apps and minimal fees.

Traditional banks often feel outdated with their paper forms and limited hours. Digital alternatives offer real-time notifications, automatic savings features, and early paycheck access. This shift represents more than convenience—it fundamentally changes how people interact with financial institutions and manage daily transactions.

14. Minimalist Money Philosophy

Marie Kondo’s influence extends beyond closets to millennial financial habits. Many embrace minimalism as both lifestyle and money management approach, questioning each purchase’s necessity and value.

Less stuff means lower expenses and smaller living spaces. This mindset shift helps many escape consumerism traps that ensnared previous generations. Minimalism often pairs with environmentalism, creating financial decisions that align with broader values about consumption and waste.

15. Delayed Family Formation

Marriage and children are happening later—if at all—for financial reasons. Many millennials postpone these traditional milestones until achieving career stability and debt reduction.

Student loans often delay family formation by years. This generation witnessed their parents struggle with work-family balance and financial stress. Their cautious approach to family planning reflects both economic pragmatism and changing social values, with significant implications for housing markets and consumer spending patterns.

16. Purpose-Driven Careers

Passion frequently trumps paycheck in millennial career decisions. Many choose meaningful work aligned with personal values, even when it means earning less initially.

This generation seeks purpose beyond profit, having grown up with environmental concerns and social justice awareness. They’re more likely to join nonprofits, start social enterprises, or choose companies with strong missions. This priority shift fundamentally changes career trajectories and associated financial planning needs.

17. Social Media Financial Education

TikTok and Instagram have become surprising personal finance classrooms for millennials. They follow financial influencers for advice on investing, debt management, and budgeting.

Traditional financial education often failed this generation. Social platforms fill knowledge gaps with accessible, relatable content. While quality varies widely, these informal learning channels have democratized financial information that was previously limited to those with advisors or specialized education.

18. Mental Health Financial Integration

Money and mental wellness are connected conversations for millennials. They recognize emotional spending triggers and budget for therapy alongside groceries and rent.

Financial stress impacts mental health, creating a cycle many actively manage. Self-care isn’t viewed as frivolous but as essential maintenance. This holistic approach represents a significant departure from previous generations who often separated financial decisions from emotional wellbeing.

19. Credit Card Caution

Credit card debt terrifies many millennials who watched parents struggle with high-interest burdens. They’re more likely to use debit cards or pay credit balances in full monthly.

Coming of age during the 2008 financial crisis created lasting wariness of consumer debt. When they do use credit, it’s often strategic—for points, rewards, or building credit scores. This conservative approach contradicts stereotypes about irresponsible spending and reflects hard-learned lessons about financial risk.

20. Gig Economy Participation

Traditional employment isn’t the only game in town for income-savvy millennials. Many cobble together livelihoods through multiple gig platforms like Fiverr, TaskRabbit, and freelance marketplaces.

This approach offers scheduling flexibility and diverse income streams. While challenging for stability, it provides insulation against single-employer layoffs. Gig work requires different financial management skills—handling irregular income, self-employment taxes, and benefits planning—creating new financial education needs.

21. Car Ownership Alternatives

Owning vehicles outright seems unnecessary to many millennials, especially in urban areas. They’re more likely to lease, use car-sharing services, or rely entirely on public transit and rideshares.

Cars represent depreciating assets with ongoing costs. This generation questions conventional wisdom about auto ownership as essential. Their transportation approaches reflect both financial pragmatism and environmental concerns, fundamentally changing automotive markets and urban transportation patterns.

22. Subscription Sharing Strategies

Netflix and chill—on someone else’s account! Millennials pioneered subscription sharing as legitimate financial strategy, splitting costs of streaming services, meal kits, and other subscription products.

Family plans and group discounts become community resources among friends and roommates. This collaborative consumption approach reduces individual costs while maintaining access to services. What older generations might view as cheating the system, millennials see as smart resource allocation in subscription-heavy economies.

23. Personal Brand Monetization

Hobbies aren’t just pastimes anymore—they’re potential income streams. Millennials excel at turning personal interests into monetized side projects through social media and creator platforms.

From cooking blogs to fitness coaching to handmade jewelry, passion projects become businesses. This generation understands personal brand value in digital economies. While not replacing traditional careers for most, these monetized interests provide both supplementary income and creative fulfillment outside conventional employment structures.

24. Extended Family Housing

Moving back home isn’t failure—it’s financial strategy for many millennials. They’re more likely than previous generations to live with parents into their 20s and 30s to save money.

High housing costs and student debt make multi-generational living practical. Family support systems allow faster debt repayment and stronger savings foundations. What was once stigmatized as “failure to launch” has been reframed as smart financial cooperation, especially in expensive housing markets.

25. Rewards Program Mastery

Cashback isn’t just nice—it’s necessary for budget-conscious millennials. They strategically use rewards programs, stacking benefits across credit cards, apps, and loyalty systems.

Points optimization becomes almost gamified, with millennials researching best combinations for maximum returns. This approach transforms everyday spending into wealth-building opportunity. While previous generations might have used simple loyalty cards, millennials create complex rewards ecosystems that significantly reduce expenses over time.

26. Salary Transparency Movement

Hush-hush compensation cultures are facing millennial rebellion. They’re more willing to discuss salaries openly with colleagues, friends, and online communities to combat pay inequality.

Transparency helps identify unfair pay practices and strengthens negotiation positions. Many use anonymous platforms like Glassdoor to research market rates. This openness contradicts previous generations’ privacy norms but serves as powerful tool for addressing systemic wage gaps and ensuring fair compensation.

27. FIRE Movement Participation

Retiring at 65? Many millennials aim decades earlier through the Financial Independence, Retire Early movement. They aggressively save 50-70% of income while living frugally.

FIRE followers prioritize investment growth over current consumption. Their goal isn’t traditional retirement but freedom from financial necessity. This radical approach challenges conventional career timelines and consumption patterns, representing fundamental shifts in how some millennials view work, money, and life purpose.

28. Crowdfunding Utilization

GoFundMe has become an unofficial safety net for millennials facing medical bills, emergencies, or creative project funding needs. They turn to collective support where previous generations might have sought loans.

Crowdfunding platforms democratize access to capital outside traditional banking systems. While sometimes criticized as begging, these platforms reflect community-based financial support structures. This approach recognizes both institutional failures in healthcare and education funding and the power of distributed giving.

29. Self-Directed Investing Approach

Financial advisors seem unnecessary to many tech-savvy millennials who prefer researching and managing investments themselves. They use trading apps and online resources to build personalized portfolios.

Commission-free platforms like Robinhood democratized market access. This generation often trusts their research over professional advice, particularly after witnessing financial industry failures. While sometimes leading to higher risk exposure, this DIY approach reflects both technological comfort and institutional skepticism.

30. Environmental Investment Screening

Fossil fuel companies need not apply to millennial investment portfolios. Many screen investments for environmental impact, choosing sustainable funds even with potentially lower returns.

Climate change concerns drive this generation to align investments with environmental values. ESG (Environmental, Social, Governance) funds have grown dramatically in response to this demand. This approach fundamentally challenges traditional investment philosophy that separated financial decisions from ethical considerations.

31. Time-Value Recalculation

Millennials often value time more than additional dollars. They’ll accept lower salaries for reduced commutes, flexible schedules, or increased vacation time.

This generation calculates the real hourly rate of jobs including unpaid overtime and commuting hours. Many deliberately choose careers and lifestyles optimizing time wealth over material wealth. This fundamental shift challenges traditional career success metrics and reflects changing priorities about what constitutes true prosperity.