Bitcoin promised to revolutionize money, but nobody mentioned the wild rollercoaster ride that came with it. From devastating hacks that wiped out millions to crashes that left investors broke overnight, the cryptocurrency world has been anything but smooth sailing.

Behind every success story lies a graveyard of lost fortunes, forgotten passwords, and shattered dreams. Buckle up as we explore the most shocking disasters that rocked the Bitcoin universe.

1. The 2011 Mt. Gox Hack – The First Major Bitcoin Disaster

Picture this: you’re handling 70% of all Bitcoin transactions worldwide, and suddenly everything vanishes into thin air. Mt. Gox wasn’t just any exchange—it was the king of Bitcoin trading until hackers made off with 850,000 BTC in 2011.

The platform limped along for three years before finally collapsing in 2014. Thousands of users watched their life savings disappear overnight, with no insurance or government bailout to cushion the blow.

At today’s prices, those stolen coins would be worth billions. Many victims are still fighting legal battles, hoping to recover even a fraction of their lost Bitcoin fortunes.

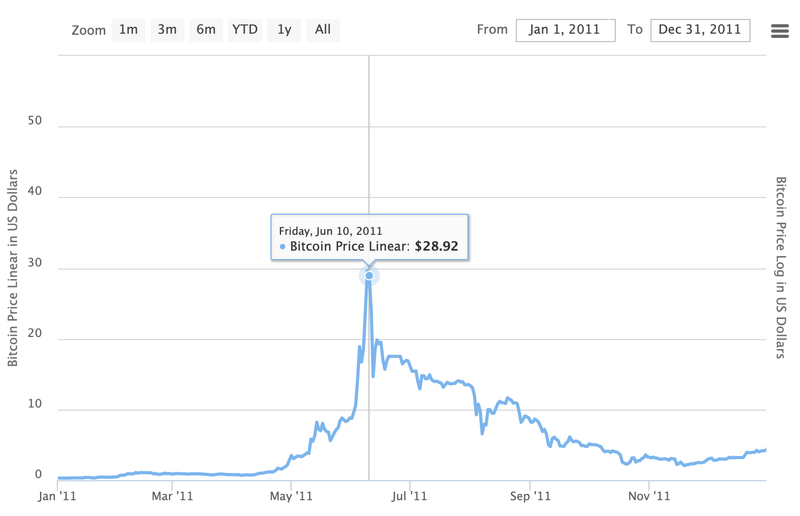

2. Bitcoin’s First Major Crash – From $32 to $2

June 2011 felt like Bitcoin’s moment of glory when it hit $32 per coin. Early adopters were counting their millions, planning retirement, and bragging to friends about their genius investment strategy.

Then reality struck like a sledgehammer. Within months, Bitcoin plummeted to just $2, erasing 94% of its value. A hack and widespread panic selling created a perfect storm that left portfolios in ruins.

Many investors who thought they were crypto millionaires found themselves holding nearly worthless digital coins. The crash taught everyone that Bitcoin’s wild price swings could work both ways—and the downside was brutal.

3. The $500 Million Coincheck Hack (2018)

Japan’s Coincheck exchange seemed rock-solid until January 2018, when hackers pulled off one of crypto’s biggest heists. Half a billion dollars in NEM tokens disappeared in what felt like a digital bank robbery.

The breach exposed glaring security flaws that shocked the crypto community. Hot wallets storing massive amounts of cryptocurrency proved to be sitting ducks for skilled cybercriminals.

Japanese regulators scrambled to implement stricter rules, while Coincheck users faced months of uncertainty about recovering their funds. The hack became a wake-up call about the vulnerabilities lurking in cryptocurrency storage systems worldwide.

4. The Infamous Bitcoin Pizza – Worth Over $600 Million Today

Laszlo Hanyecz made history on May 22, 2010, but probably wishes he hadn’t. He traded 10,000 Bitcoin for two Papa John’s pizzas, creating the first real-world Bitcoin transaction.

Back then, those coins seemed like funny internet money worth about $40 total. Today, that same amount would buy you a mansion, a yacht, and probably the entire pizza chain.

We now celebrate Bitcoin Pizza Day every year, though it’s more of a painful reminder than a celebration. Hanyecz’s expensive meal proves that sometimes being a pioneer comes with a hefty price tag that keeps growing.

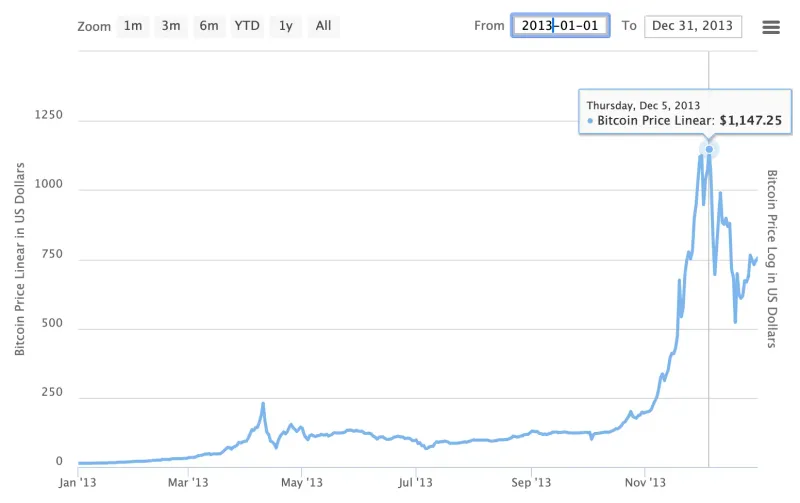

5. The 2013 Bubble – When Bitcoin Hit $1,000 Then Collapsed

Bitcoin fever reached new heights in late 2013 when the price smashed through $1,000 for the first time. Media coverage exploded, dinner conversations turned to cryptocurrency, and everyone wanted in on the action.

The party didn’t last long. By 2015, Bitcoin had crashed to around $200, leaving countless investors nursing massive losses. The 80% decline wiped out fortunes and shattered confidence across the crypto space.

Mainstream media declared Bitcoin dead, and many investors swore off cryptocurrency forever. The crash became a harsh lesson about market bubbles and the dangers of following the crowd into speculative investments.

6. Bitfinex Hack (2016) – $72 Million Gone in Minutes

Bitfinex users went to sleep thinking their Bitcoin was safe and woke up to a nightmare. Hackers had stolen nearly 120,000 BTC worth $72 million, making it one of the largest crypto thefts ever.

The exchange’s response was unprecedented—they issued BFX tokens to affected users, essentially creating IOUs for the stolen funds. Many thought they’d never see their money again.

Surprisingly, Bitfinex eventually bought back all the tokens and repaid users in full. However, the hack highlighted how quickly fortunes could vanish in the largely unregulated cryptocurrency world, leaving investors vulnerable to sophisticated cybercriminals.

7. QuadrigaCX CEO Dies – And $190 Million Vanishes

Gerald Cotten’s sudden death in India during 2018 seemed tragic until the truth emerged. The QuadrigaCX founder had allegedly taken the private keys to $190 million in user funds to his grave.

Customers couldn’t access their money because only Cotten knew the passwords to the exchange’s cold storage wallets. The story grew stranger when blockchain analysis revealed suspicious wallet activity after his supposed death.

Many believe Cotten faked his death and ran off with the funds. The scandal left thousands of Canadians broke and highlighted the risks of trusting centralized exchanges with life savings.

8. The 2020 Pandemic Crash – From $10K to $3.8K in Days

March 2020 tested Bitcoin’s reputation as “digital gold” when global markets crashed due to COVID-19 fears. Instead of acting as a safe haven, Bitcoin plummeted alongside everything else.

The cryptocurrency lost more than 50% of its value in just two days, falling from around $10,000 to $3,800. Leveraged traders got liquidated, and panic selling accelerated the decline.

However, Bitcoin’s recovery was spectacular. By the end of 2020, it had reached new all-time highs, proving its resilience. The crash taught investors that Bitcoin could be both a risk asset and a hedge, depending on market conditions.

9. The Rise of Rug Pulls and Crypto Scams

OneCoin promised to be the “Bitcoin killer” but turned out to be one of history’s biggest Ponzi schemes. Founder Ruja Ignatova, dubbed the “Cryptoqueen,” vanished with billions in investor funds.

Bitconnect followed a similar playbook, promising impossible returns through their lending platform. When the house of cards collapsed, investors lost everything while promoters disappeared with the money.

These scams continue today through “rug pulls” where developers abandon projects after raising funds. The crypto space remains a Wild West where legitimate innovation mingles with sophisticated fraud, making due diligence absolutely crucial for survival.

10. The 2021 China Mining Ban – Market in Freefall

China’s mining ban in 2021 sent shockwaves through the Bitcoin network when the country outlawed cryptocurrency mining and trading. Miners who had invested millions in equipment suddenly became criminals overnight.

Bitcoin’s hash rate plummeted as mining farms went dark across China. The network’s security temporarily weakened, and Bitcoin’s price tumbled as fear gripped the market.

Miners fled to friendlier countries like Kazakhstan and the United States, creating a massive migration of mining equipment. While Bitcoin eventually recovered, the ban proved how government actions could still severely impact the supposedly decentralized cryptocurrency ecosystem.

11. Losing a Fortune with One Lost Password

Stefan Thomas, a programmer living in San Francisco, owns 7,002 Bitcoin worth over $200 million. There’s just one problem—he can’t access any of it because he forgot his password.

The coins sit locked on an IronKey hard drive that will permanently encrypt itself after 10 failed password attempts. Thomas has already used up eight tries, leaving him with just two chances to become incredibly wealthy.

His story represents thousands of similar cases where people lost access to Bitcoin fortunes through forgotten passwords or damaged storage devices. Sometimes the biggest enemy isn’t hackers or market crashes—it’s human forgetfulness.

12. Terra-Luna Collapse – Bitcoin Dragged Down

Terra-Luna’s algorithmic stablecoin experiment went horribly wrong in May 2022, wiping out over $40 billion in crypto wealth within days. The supposedly stable TerraUSD lost its dollar peg and spiraled to zero.

Bitcoin took a beating because many DeFi protocols held it in reserve to back their operations. As these projects unwound positions to cover losses, massive selling pressure hit the market.

The collapse exposed how interconnected the crypto ecosystem had become. Even though Bitcoin itself wasn’t flawed, its price suffered from the contagion effect as investors fled anything crypto-related during the chaos.

13. FTX Implosion (2022) – The “Lehman Moment” of Crypto

FTX seemed like crypto’s golden child until November 2022, when fraud allegations and insolvency rumors brought down Sam Bankman-Fried’s empire in spectacular fashion. The exchange had been using customer funds for risky trades.

Bitcoin’s price plummeted as the scandal unfolded, falling from around $21,000 to under $16,000. Trust in centralized exchanges evaporated, and the entire industry faced a credibility crisis.

The FTX collapse became crypto’s “Lehman moment,” similar to the 2008 financial crisis. It reminded everyone that even the most respected players in crypto could be hiding massive fraud behind polished marketing campaigns.

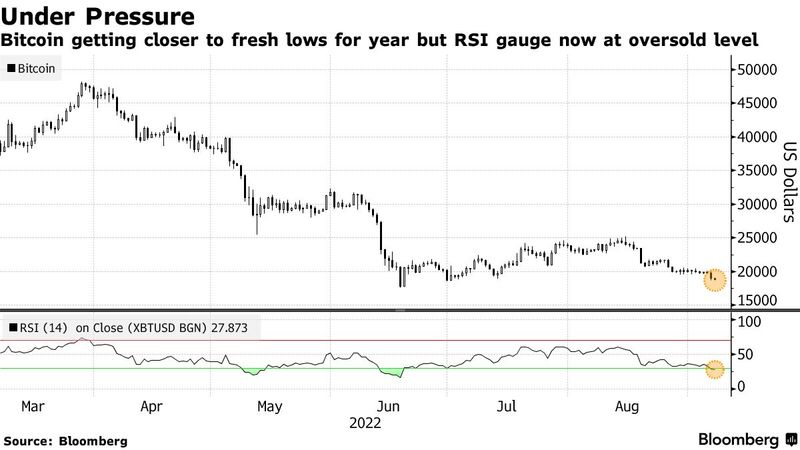

14. The 2022 Crypto Winter – A Long, Cold Year

Following a cascade of crashes, hacks, and regulatory threats, 2022 became known as the “crypto winter.” Bitcoin tumbled from its 2021 high of $69,000 to under $16,000 by year’s end.

Major crypto companies filed for bankruptcy, thousands of employees lost their jobs, and venture capital funding dried up. The euphoria of 2021 gave way to despair and disillusionment across the industry.

Media outlets once again declared Bitcoin dead, and many investors swore off crypto forever. The prolonged bear market tested the resolve of even the most dedicated believers, proving that crypto winters can be brutal and long-lasting.

15. Yet, Bitcoin Survived It All

Despite every crash, hack, ban, and scandal, Bitcoin keeps proving the doubters wrong. It has been declared “dead” by mainstream media over 400 times, yet it continues to rise from the ashes.

Each crisis that should have killed Bitcoin only made it stronger. The network adapted, improved its security, and attracted new believers who saw opportunity in the chaos and volatility.

Today, Bitcoin is accepted by major corporations, embraced by institutional investors, and recognized as legal tender in some countries. Its survival story proves that true innovation can withstand any storm, no matter how devastating it might seem at the time.