Navigating the world of retirement often means reassessing financial priorities. For many, this includes cutting out unnecessary expenses that no longer serve a practical purpose.

In this blog post, I share 20 things I no longer buy, shedding light on smarter spending habits that contribute to a more fulfilling and financially stable lifestyle.

1. Cable TV

Cable TV used to be the go-to for all entertainment needs, but not anymore. With streaming services like Netflix, Hulu, and Amazon Prime, there’s endless content available at a fraction of the cost.

Free over-the-air channels also offer a variety of shows without the hefty bills. Cutting the cord not only saves money but also simplifies choices, reducing the overwhelming options cable often presents. It’s liberating to choose only the services you genuinely enjoy.

The shift to digital platforms is both a financial decision and a lifestyle change, offering freedom from contracts and hidden fees.

2. Expensive Coffee from Cafés

Those daily trips to the café for a fancy latte can quickly add up. Brewing coffee at home provides a similar experience at a fraction of the cost. Investing in a quality coffee maker and experimenting with different beans can elevate the experience.

It’s not just about saving money, but also about enjoying the process of making your own brew. Personalized coffee rituals at home can be both relaxing and rewarding.

Over time, the savings from skipping café visits contribute significantly to the budget. Plus, the comfort of home often beats the bustling atmosphere of a café.

3. Brand-Name Medications

Switching to generic medications has been a game-changer in managing health expenses. These alternatives offer the same active ingredients and effectiveness as their brand-name counterparts but at a much lower price. It’s a smart financial move that doesn’t compromise health quality.

Consulting with a healthcare provider can help identify suitable generic options. This switch has made a noticeable difference in monthly budget allocations for healthcare. The peace of mind that comes with effective treatment without the hefty price tag is invaluable.

It’s a simple change with considerable impact on long-term savings and well-being.

4. New Cars

Purchasing a new car might seem appealing, but the rapid depreciation makes it a poor investment. Opting for used or certified pre-owned vehicles is a more economical choice that saves thousands.

Cars lose significant value once driven off the lot, and this loss is avoidable. Used cars offer reliability and longevity without the extra cost. It’s essential to research and choose a reputable dealer to ensure quality.

The money saved can be redirected towards other needs or experiences. Ultimately, it’s a decision that balances practicality with financial prudence, making life after retirement more enjoyable.

5. Extended Warranties

Extended warranties often promise security but rarely provide value. Most products are built to last well beyond their standard warranty periods. In many cases, the cost of the warranty exceeds potential repair expenses.

Relying on well-made products and regular maintenance can avoid unnecessary costs. It’s crucial to assess the likelihood of problems before purchasing warranties. This mindset saves money and prevents cluttering finances with unnecessary services. Over time, the savings from skipping extended warranties accumulate, contributing to a more streamlined budget.

This practical approach prioritizes real needs over hypothetical concerns, enhancing financial stability.

6. Designer Clothing

Designer brands often charge premium prices for logos rather than quality. Opting for comfort and durability without the designer label saves significantly. It’s possible to find stylish and well-made clothing without breaking the bank.

Prioritizing material and craftsmanship over brand names makes an insightful difference. This choice supports a closet full of versatile pieces that mix and match effortlessly. The switch encourages a personal style that isn’t dictated by fleeting trends. Embracing quality over brand prestige leads to a wardrobe that withstands time and maintains budget integrity.

It’s a fashion-forward decision that aligns with sensible spending.

7. Cheap Dollar Store Gadgets

Cheap gadgets from dollar stores may seem like a bargain but often prove otherwise. They tend to break quickly, leading to frequent replacements and accumulated costs. Investing in slightly more expensive, well-made alternatives ensures longevity and reliability.

This shift reduces clutter and the environmental impact of disposable items. Choosing quality over quantity is a smarter financial strategy, leading to fewer frustrations from malfunctioning products. It’s a sustainable approach that emphasizes thoughtful purchasing decisions.

The money saved in the long run reinforces the value of buying once and buying well, aligning with a mindful consumer philosophy.

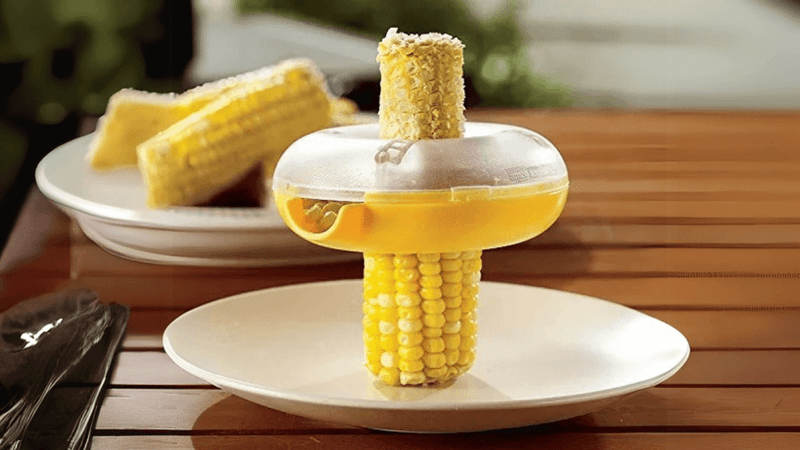

8. Single-Use Kitchen Gadgets

Single-use gadgets often promise convenience but result in a cluttered kitchen. Multi-purpose tools serve better without taking up excess space or funds. The attraction of trendy kitchen items fades quickly as practicality takes precedence.

Investing in versatile utensils simplifies cooking and reduces unnecessary spending. This approach enhances culinary creativity by focusing on essential tools. Thoughtful purchases ensure each item has multiple uses, maximizing functionality. Over time, this leads to a more organized kitchen and streamlined cooking process.

It’s a step towards a minimalist lifestyle that values space and efficiency, translating into savings and satisfaction.

9. Paper Towels

Switching from paper towels to cloth alternatives has made a noticeable impact on reducing waste. Reusable towels offer the same functionality without the environmental footprint.

They are versatile, durable, and can be washed and reused countless times. This change not only cuts costs but also contributes to a greener lifestyle. Investing in cloth towels is a simple yet effective step towards sustainability.

The transition to reusable options aligns with a broader commitment to reducing single-use products. Over time, this practice conserves resources and supports a cleaner environment, reflecting a dedication to responsible living.

10. Gym Memberships

Traditional gym memberships can be expensive with added travel time. However, staying active doesn’t require a costly membership. Activities like walking, gardening, and home workouts offer ample exercise at no cost. This shift fits seamlessly into daily routines, promoting physical health without financial strain. Embracing outdoor activities adds variety and enjoyment.

Building a home workout routine is affordable and convenient, encouraging consistency. The absence of gym fees frees up funds for other interests. This practical approach to fitness supports a balanced lifestyle, demonstrating that good health needn’t come with high costs.

11. Fast Fashion

Fast fashion tempts with low prices but often lacks quality, leading to frequent replacements. Choosing durable, timeless pieces reduces waste and promotes sustainable habits. Investing in quality ensures clothing remains wearable for years, saving money and resources.

This shift encourages thoughtful purchasing and long-term satisfaction. A focus on classic styles provides versatility and transcends fleeting trends. Over time, a wardrobe built on quality over quantity curtails clutter and supports ethical production practices. It’s a mindful way to enjoy fashion while maintaining financial discipline.

Embracing this change reflects a commitment to responsible consumerism.

12. Premium Gasoline

Unless the car manufacturer specifies premium gasoline, regular works just fine. Using premium without necessity is an avoidable expense. Understanding engine requirements prevents overspending at the pump. Consulting the owner’s manual or a trusted mechanic can clarify the best fuel type. Sticking to regular gas maintains car performance without the extra cost.

This simple adjustment in fueling habits saves money steadily over time. It’s a practical decision that aligns with informed spending. By choosing the right fuel, resources are optimized, translating into financial savings and efficient vehicle maintenance.

13. Magazine & Newspaper Subscriptions

With vast content available online, traditional magazine and newspaper subscriptions become redundant. Many publications offer digital versions that are more cost-effective. Switching to online content reduces clutter and provides easy access to a wide range of topics. This transition supports an eco-friendly lifestyle by saving paper and resources.

Embracing digital reading habits aligns with modern technology and convenience. It’s a practical choice that offers flexibility in consuming news and articles anytime, anywhere. The switch signifies adapting to contemporary media consumption, reflecting a thoughtful approach to staying informed without unnecessary expenses.

14. Bottled Water

Bottled water may seem convenient but is costly and wasteful. Using a reusable water bottle and a good filter offers the same hydration without environmental harm. This change significantly reduces plastic consumption and saves money. Investing in a quality water filter ensures clean, safe drinking water at home.

The convenience of having filtered water readily available outweighs the perceived benefits of bottled options. This sustainable choice reflects a commitment to minimizing waste and conserving resources.

Embracing reusable solutions is not just eco-friendly but financially wise, contributing to a more mindful lifestyle.

15. High-End Smartphones Every Year

The tech industry’s push for constant upgrades can be tempting, but unnecessary. High-end smartphones are built to last several years, making annual purchases wasteful. Most phones offer updates and features that keep them relevant for a longer time.

Opting to use a phone until it truly needs replacement saves substantial money. This approach fosters a mentality of valuing longevity over novelty. It encourages a focus on functionality rather than superficial upgrades.

By resisting the urge to constantly upgrade, financial resources are preserved, aligning with a practical and sustainable consumer perspective.

16. Fancy Holiday Decorations

Commercial holiday decorations often come with hefty price tags. Creating DIY or using sentimental decorations brings the same festive joy without overspending. Personalizing decorations adds emotional value and uniqueness. This creative approach makes the holidays more meaningful and less commercialized.

Involving family in decoration-making fosters bonding and cherished memories. Reusing and repurposing old decorations supports sustainable habits. This shift highlights the spirit of the season, focusing on togetherness and creativity rather than material excess.

It’s a heartfelt way to celebrate, emphasizing values over spending, and preserving budget for more significant holiday experiences.

17. Name-Brand Cleaning Products

Brand-name cleaning products often come at a premium, but homemade solutions and generic brands work just as well. Simple ingredients like vinegar and baking soda can tackle most cleaning tasks effectively. This switch reduces household expenses and exposure to harsh chemicals.

Crafting homemade cleaners offers customization to specific cleaning needs. It’s a cost-effective and environmentally friendly approach. Generic products provide similar results without the brand-associated costs. Over time, these choices significantly cut spending on cleaning supplies.

This practical strategy reflects a commitment to frugality without sacrificing cleanliness or hygiene.

18. Lottery Tickets

Lottery tickets promise dreams of fortune but rarely deliver. The odds are overwhelmingly against winning, making this habit a financial drain. Allocating money towards more secure investments or savings yields better returns.

Understanding the low probability of success helps in making informed financial decisions. Resisting the allure of quick riches cultivates a mindset focused on practical financial goals. It’s a realization that wealth building is better achieved through consistent saving and investment.

This change emphasizes sound financial planning over gambling, encouraging a healthier relationship with money that benefits long-term security.

19. Pre-Cut Fruits & Vegetables

Pre-cut fruits and vegetables may save time but come at a premium. Buying whole produce and preparing it at home is more cost-effective. This choice also ensures freshness and extends the shelf life of groceries. Investing a little time in food preparation leads to significant savings.

This approach encourages a connection with the food process, promoting healthier eating habits. The trade-off between convenience and cost is evident, and embracing home preparation aligns with budget-friendly practices.

It’s a simple way to reduce grocery bills while enjoying fresh and vibrant produce. This decision reflects a thoughtful approach to consumption.

20. Cable News Channels

The constant stream of negativity from cable news channels can be overwhelming. Opting for online news sources or public broadcasting services like PBS provides balanced information without clutter.

This shift reduces exposure to sensationalism and promotes a more informed perspective. It frees up funds previously allocated to cable subscriptions, supporting a more streamlined media consumption approach. The decision encourages selective engagement with news, focusing on quality over quantity.

This change aligns with a broader desire for tranquility and informed living, offering a reprieve from the relentless cycle of broadcast news distractions.