Throughout American history, taxes have been levied on a variety of unexpected items.

From everyday goods to peculiar personal attributes, these taxes reflect the evolving economic and social landscape of the nation.

Here’s a look at ten surprising things that Americans have been taxed on, each highlighting a unique slice of history and society.

1. Playing Cards & Dice

Playing cards and dice, symbols of leisure, faced taxation under the British Stamp Act of 1765. In colonial America, these taxes were inherited and sometimes adapted by the new nation. Imagine the colonial taverns filled with lively games, where every roll of the dice was subject to a tax. This not only impacted casual gamblers but also professional card players, making it a tax on entertainment and chance. Such taxes highlighted the influence of British customs on American society, where even the simplest pleasures came at a price.

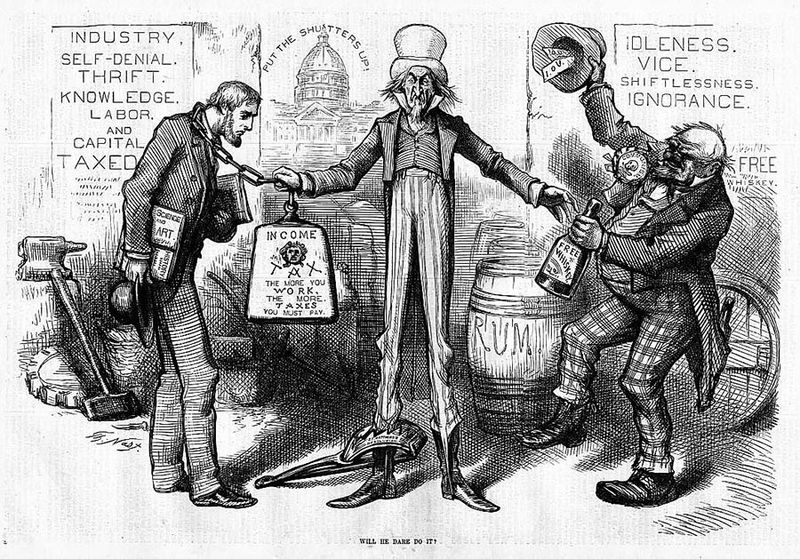

2. Whiskey

Whiskey, a beloved American spirit, was the subject of the first federal excise tax in 1791. This tax aimed to reduce national debt but led to the infamous Whiskey Rebellion. Imagine early American settlers crafting whiskey in small stills, only to face government collectors. The rebellion it sparked was a critical test of federal authority, reflecting the tensions between frontier communities and the nascent federal government. This whiskey tax highlighted the economic struggles of the time, where taxing spirits became a contentious symbol of American resistance.

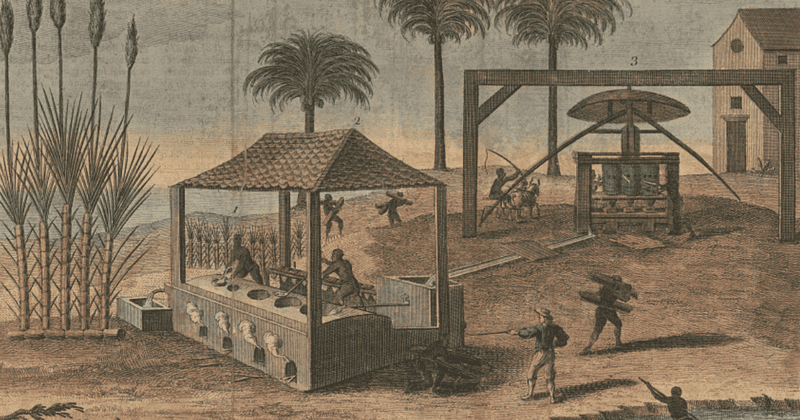

3. Sugar

Sugar, a staple in every household, was taxed under the British Sugar Act of 1764. This tax fueled colonial resentment and played a significant role in igniting the American Revolution. Picture the colonial households, where the cost of sweetening a cup of tea became a matter of political protest. This tax, designed to boost British revenues, was seen as an affront to colonial autonomy. The sugar tax represented a deeper conflict over taxation without representation, setting the stage for the revolutionary fervor that followed.

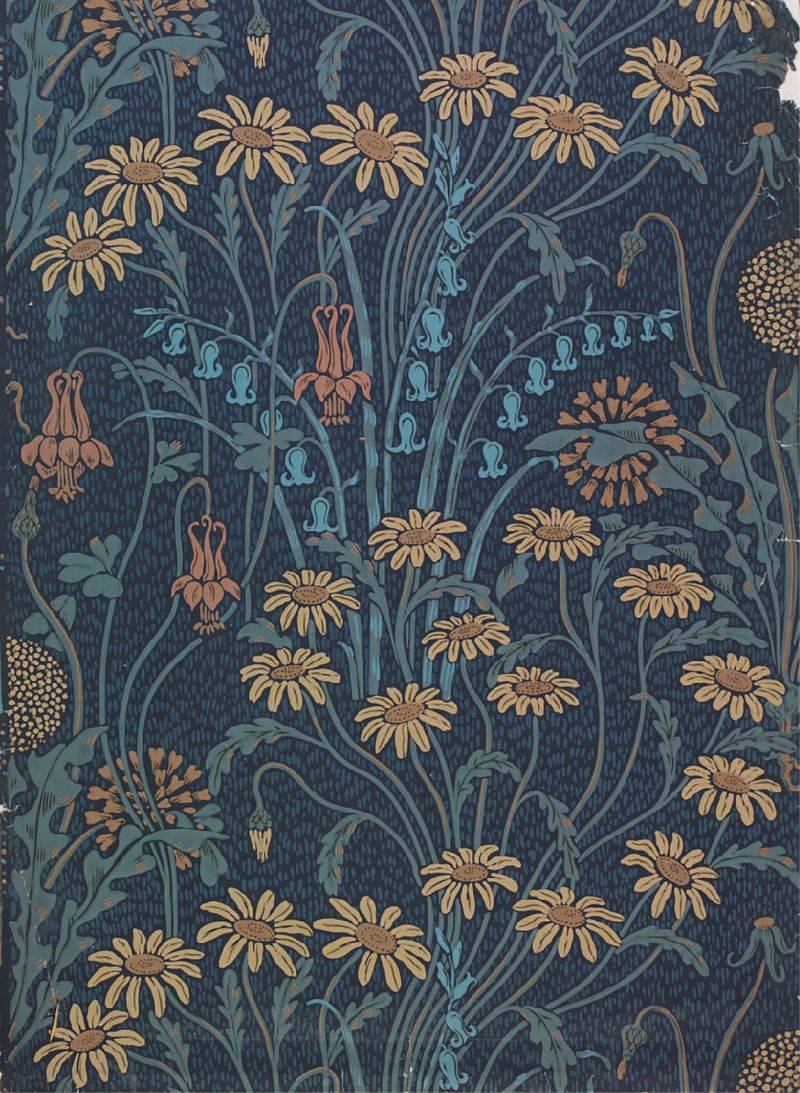

4. Colored Wallpaper

Under British rule, colored wallpaper was taxed as a luxury item, impacting colonial America’s decorative choices. These taxes were part of broader stamp duties, making every roll of wallpaper a statement of wealth. Imagine the opulent colonial homes, where each wall reflected the owner’s status and tax burden. This tax on beauty and luxury highlighted the cultural ties between Britain and its colonies, where even the choice of decor was intertwined with economic policy. Such taxes underscored the intersection of style and governance in early America.

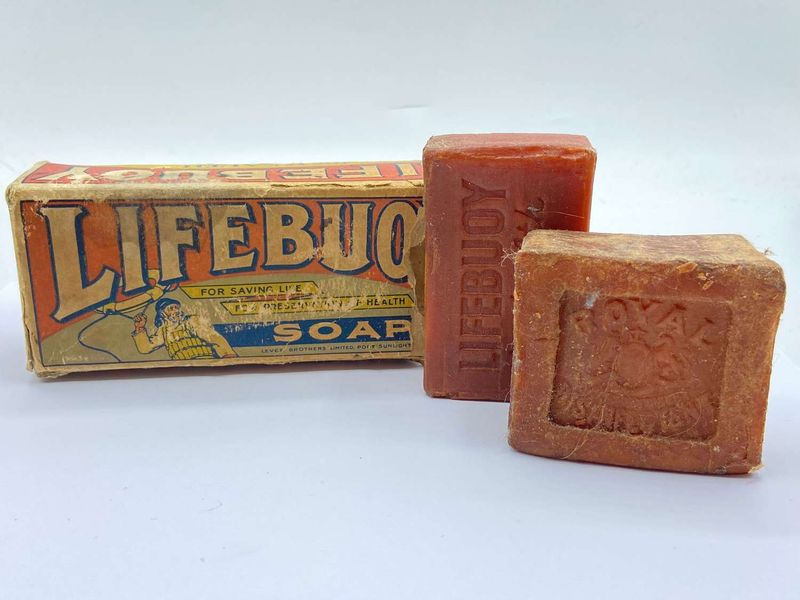

5. Soap

Soap, a basic necessity, was taxed during wartime efforts such as the Civil War and WWII. These excise taxes extended to everyday items like candles and chewing gum. Imagine the American households striving to maintain hygiene and comfort while contributing to the war effort. Wartime taxes on consumer goods reflected the national sacrifice required during periods of conflict. This tax on soap highlighted the broader strategy of funding wars through everyday consumption, connecting homefront activities to the broader national interest.

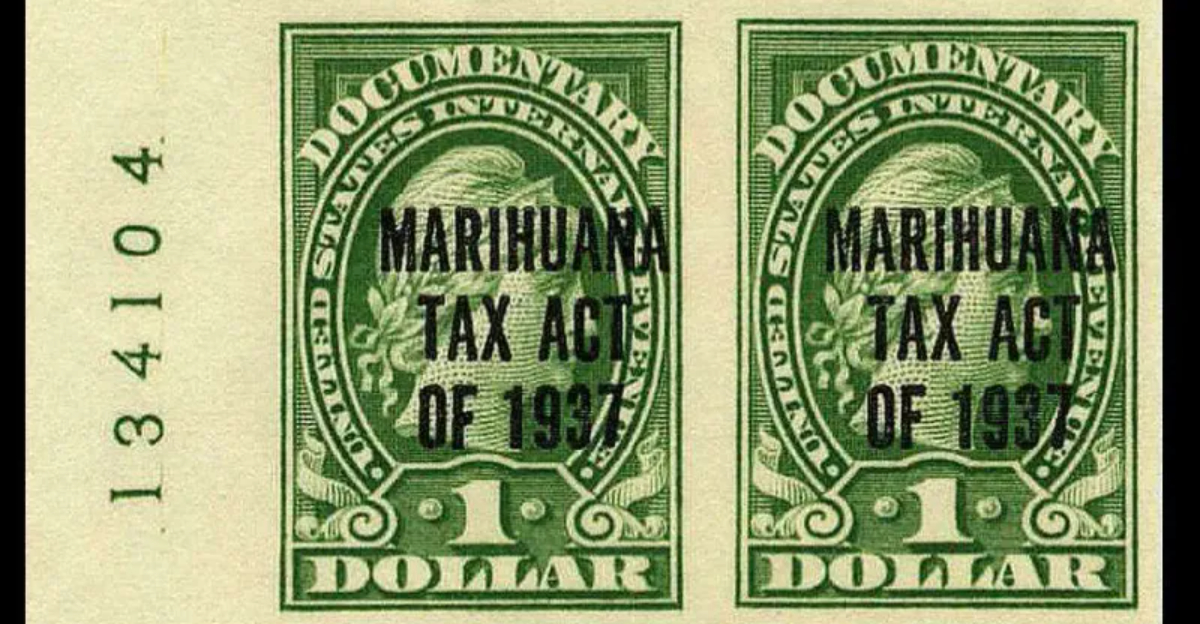

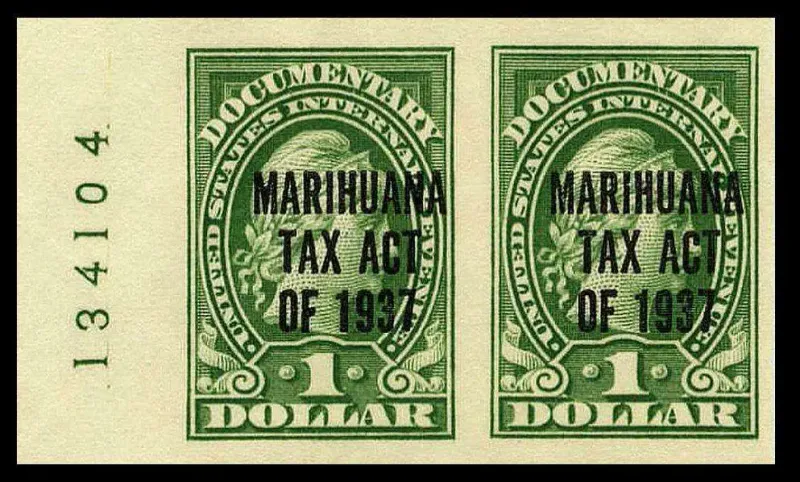

6. Illegal Drugs

Illegal drugs, notably cannabis, were taxed under the Marihuana Tax Act of 1937. This tax was a precursor to outright bans, intertwining legal and financial penalties. Imagine early 20th-century courts, where possession charges doubled as tax evasion offenses. This complex legal landscape reflected societal attempts to regulate and control drug use through fiscal measures. The taxation of illegal drugs underscored the evolving legal approaches to substances, where taxation became a tool for public policy and control.

7. Windows

Windows, essential to homes, were taxed in Europe, and some colonial areas adopted similar practices. This led to the bricking up of windows to avoid taxes. Picture the colonial homes, where the decision to let in light was balanced against economic considerations. Though not widespread in the U.S., the idea of taxing windows reflected European influences on colonial taxation policies. This tax represented the broader theme of taxing essential architectural features, illustrating how economic policies shaped everyday life.

8. Hats & Buttons

Hats and buttons, seemingly trivial, were subject to import tariffs in early America. These items, while not taxed individually, were part of broader clothing-related taxes. Imagine the bustling colonial markets, where fashion choices were influenced by taxation policies. These taxes highlighted the economic strategies aimed at protecting domestic industries and generating revenue. The taxation of clothing accessories underscored the complexities of early American trade and economic policy, where even the smallest details of attire were part of the fiscal landscape.

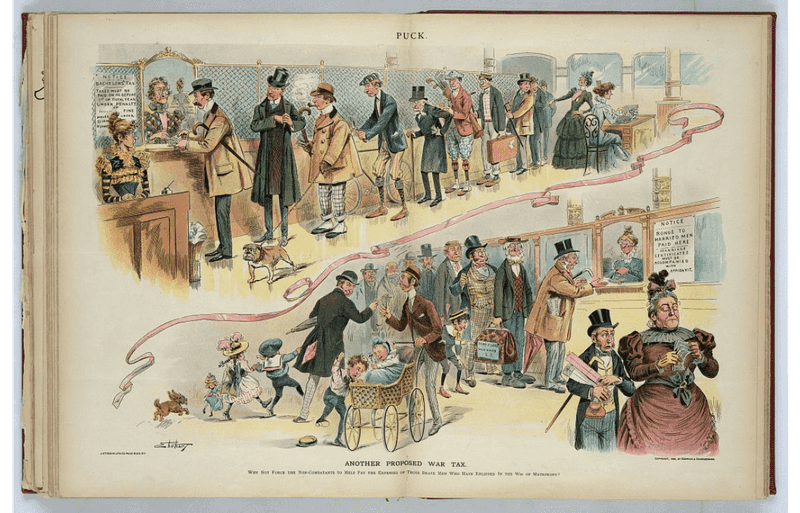

9. Bachelors

Bachelors faced proposed taxes in states like Missouri and Michigan in the early 20th century, aiming to promote marriage. These bachelor taxes, though not always enforced, reflected societal values and efforts to encourage family formation. This tax proposal highlighted the intersection of personal life and public policy, where financial incentives were used to shape social norms. The bachelor tax represented a unique approach to addressing demographic concerns through fiscal measures.

10. Beards

Beards, famously taxed in Russia by Peter the Great, were rumored to be taxed in America, though no formal federal tax existed. This myth reflects the cultural exchanges and rumors that shaped colonial society. While no serious documentation of an American beard tax exists, the idea highlights how taxation intersected with personal appearance and societal trends. This whimsical notion of a beard tax serves as a reminder of the diverse ways taxes have touched daily life.