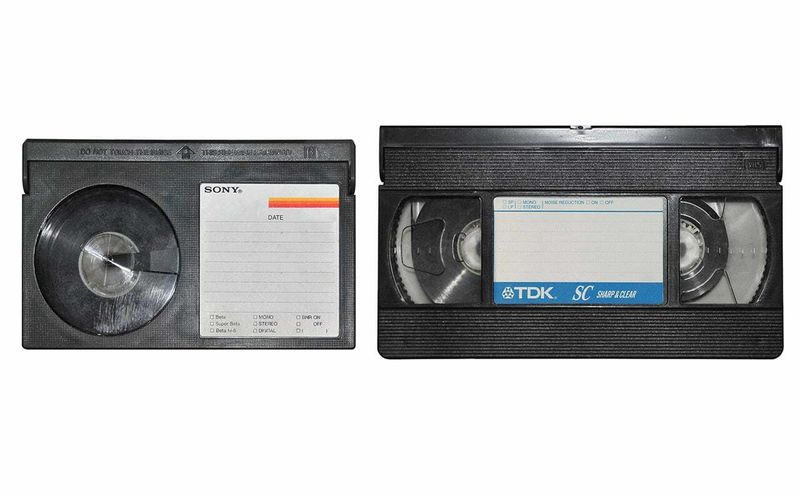

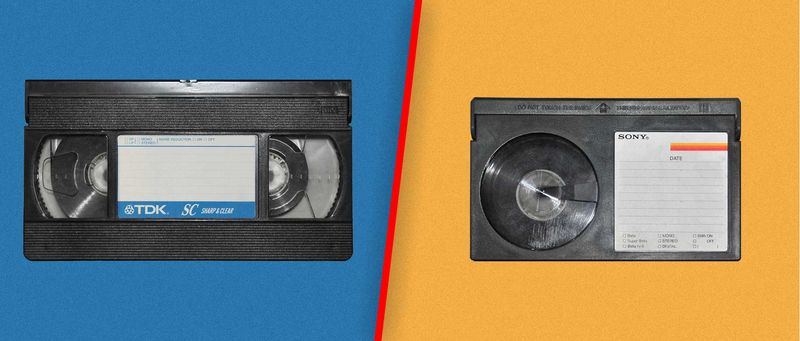

In the late 1970s and early 1980s, a fierce battle unfolded between two video cassette formats: Sony’s Betamax and JVC’s VHS. While Betamax boasted superior picture quality, VHS ultimately won the hearts—and wallets—of consumers. Here’s a look at 13 key factors that contributed to Betamax’s downfall:

1. Shorter Recording Time

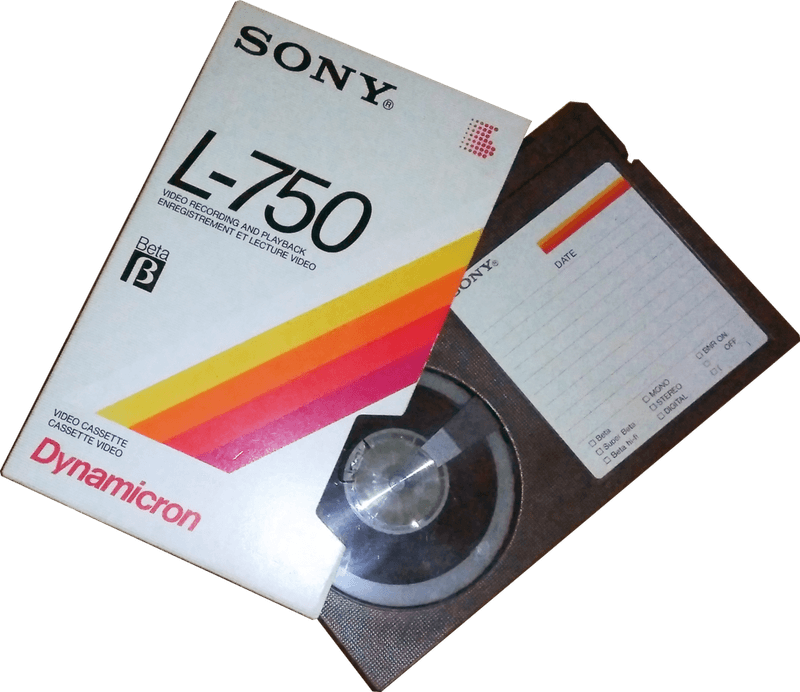

Consumers were faced with a choice between Betamax’s 60-minute recording time and VHS’s more accommodating 120-minute capacity. This limitation on Betamax tapes was particularly problematic for those who wanted to record entire movies or sports events, which often exceeded an hour.

VHS tapes provided the extra length needed, aligning more closely with consumer needs and expectations. This discrepancy in recording time became a significant factor, tipping the scales in favor of VHS as more users realized they needed longer recording capabilities for their viewing pleasure.

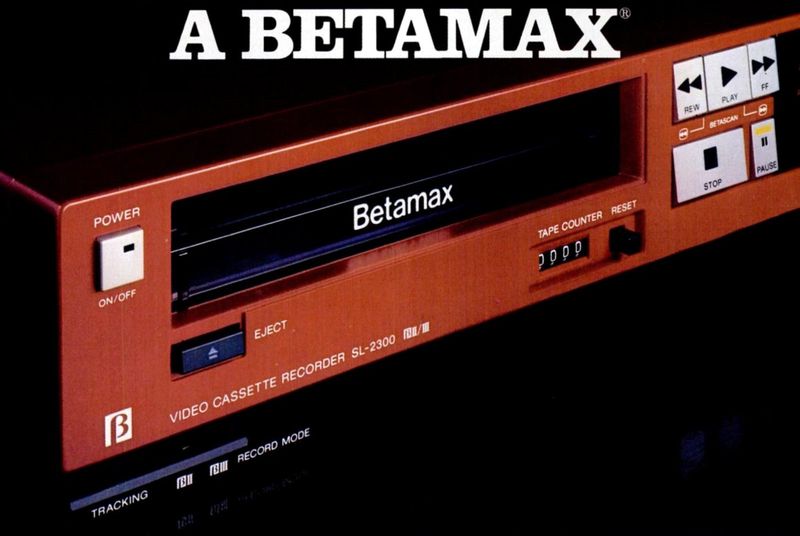

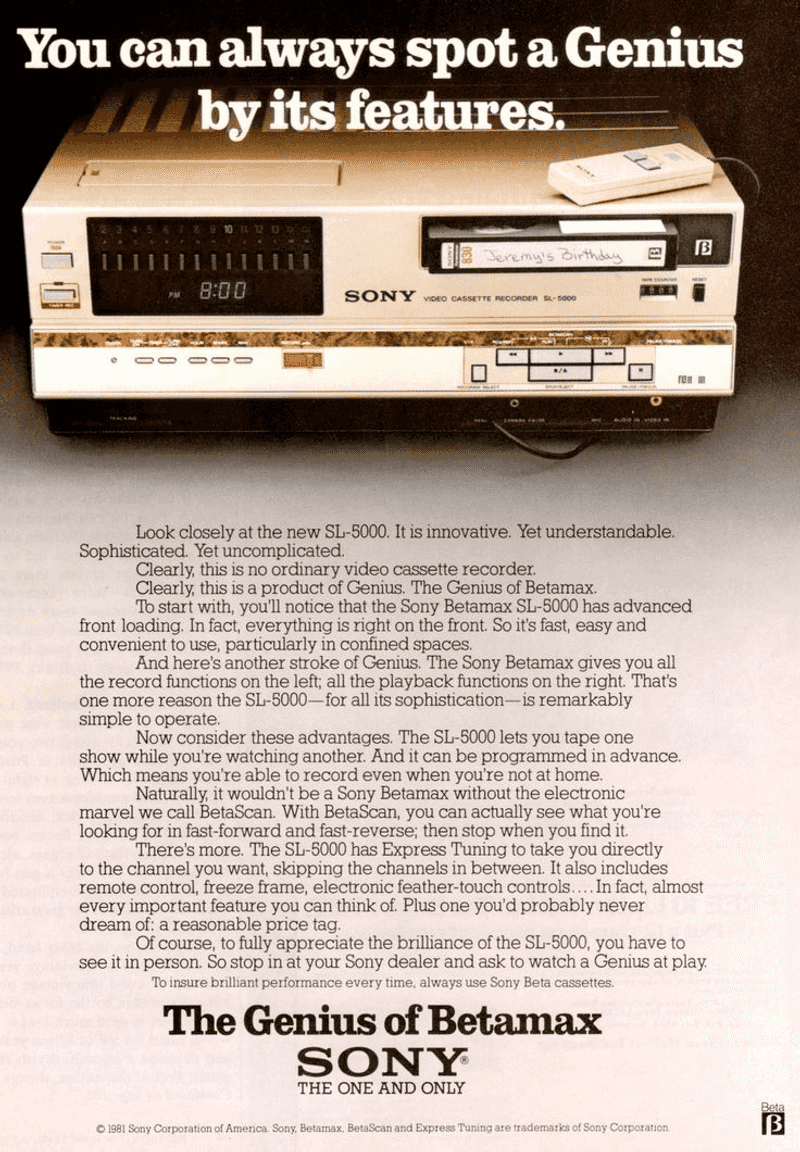

2. Higher Cost

In the bustling electronics stores of the 1980s, consumers were often greeted with the stark price disparity between Betamax and VHS machines. Betamax players, while technologically advanced, came with a heftier price tag compared to their VHS counterparts.

This higher cost made Betamax less accessible to the average consumer, who often prioritized affordability over marginal improvements in quality. Consequently, many potential buyers opted for VHS, finding it a more budget-friendly option that still delivered satisfactory performance for their home entertainment needs.

3. Limited Licensing

Sony’s decision to closely guard its Betamax technology through limited licensing agreements hampered its widespread adoption. Unlike JVC, who freely licensed their VHS format to a variety of manufacturers, Sony’s restrictive approach limited the production of Betamax machines.

This strategy meant fewer companies were able to produce and sell Betamax players, reducing its presence and availability in the market. As a result, VHS rapidly expanded with multiple manufacturers producing compatible devices, increasing consumer options and solidifying VHS as the dominant format in homes worldwide.

4. Consumer Preferences Overlooked

Sony’s focus on delivering superior picture quality with Betamax overlooked the broader consumer preferences for longer recording times and affordability. This misjudgment meant that, despite the technical advantages, Betamax failed to align with what most users prioritized in a home video recorder.

VHS, on the other hand, offered a balance between good quality and practical features that resonated with the average consumer. As a result, many chose VHS, appreciating its cost-effectiveness and ability to record longer content, which fit seamlessly into their daily entertainment habits.

5. Retailer Support

Video rental stores in the 1980s quickly recognized the advantage of stocking VHS tapes due to their longer recording capability. This feature made VHS a more attractive option for retailers, leading to a broader selection of titles available in VHS format.

Betamax, with its shorter recording time, couldn’t compete in terms of inventory diversity, which gradually reduced its shelf space in rental outlets. Retailer support thus played a pivotal role, as consumers naturally gravitated towards the format that offered a wider array of viewing options for their rental needs.

6. Market Share Decline

By 1980, the writing was on the wall for Betamax as VHS captured 70% of the U.S. home video market. This significant shift in consumer preference was marked by a noticeable decline in Betamax’s market share.

The dominance of VHS was driven by its longer recording capabilities, affordability, and broader availability. As more households adopted VHS, Betamax found itself increasingly sidelined, with dwindling sales and a shrinking presence in stores. The dramatic market share decline was a clear indicator of VHS’s superior alignment with consumer desires.

7. Delayed Response

Sony’s slow reaction to Betamax’s recording time limitations proved costly. As consumers voiced their need for longer recording times, Sony hesitated to adapt and innovate quickly enough to meet these demands.

This delay allowed VHS to establish a robust foothold in the market, offering extended recording features that Betamax lacked. While Sony eventually responded, the opportunity had passed, with many consumers already committed to the more versatile VHS format. This sluggishness in addressing critical consumer preferences hindered Betamax’s competitive edge.

8. Content Availability

As VHS gained popularity, the volume of content available in this format surged. Consumers browsing shelves found a diverse array of VHS titles, from blockbuster movies to niche genres, which greatly enhanced its appeal.

In contrast, the limited availability of Betamax tapes restricted consumer choice and interest. The extensive content library offered by VHS manufacturers made it the go-to option for viewers seeking variety and accessibility in their home entertainment experience. This disparity in content availability further cemented VHS’s dominance in the market.

9. Consumer Confusion

The presence of two incompatible video formats led to widespread consumer confusion in the market. Many potential buyers were unsure about which format to invest in, fearing obsolescence if they picked incorrectly.

As VHS began to dominate in terms of availability and retailer support, consumers increasingly leaned towards the safer bet. The reassurance of VHS’s widespread use and support alleviated concerns, while Betamax, with its narrower adoption, appeared more risky. This confusion and desire for certainty ultimately shifted more consumers towards VHS, contributing to Betamax’s decline.

10. Retailer Preferences

Retailers played a crucial role in the VHS vs Betamax battle, often favoring VHS due to its popularity and the wider range of available titles. This preference translated into more shelf space dedicated to VHS tapes, providing consumers with more choices and easier access.

Betamax, with its limited selection, was often relegated to less prominent areas in stores. The visible preference for VHS in retail environments reinforced consumer perception of VHS as the superior format, further driving its adoption and leaving Betamax struggling to compete in the marketplace.

11. Marketing Strategies

JVC and its partners executed effective marketing strategies that highlighted VHS’s advantages, such as longer recording times and affordability. These campaigns resonated well with consumers, emphasizing the practical benefits of choosing VHS over Betamax.

The marketing prowess of JVC capitalized on consumer interests, creating a strong brand association with user-friendly features and value for money. This clever positioning in the minds of the public played a critical role in swaying consumer opinion, cementing VHS as the preferred choice for home video recording.

12. Technological Evolution

While Betamax remained focused on maintaining superior video quality, VHS continued to innovate and evolve. Features such as extended play modes, which allowed for even longer recording times, were introduced, catering to the evolving needs of consumers.

This continuous technological evolution ensured that VHS remained relevant and competitive, offering features that Betamax couldn’t match. By prioritizing feature enhancements alongside affordability, VHS maintained its appeal and adaptability, ultimately securing its place as the leading video format of its time.

13. Sony’s Shift to VHS

By 1988, even Sony, the creator of Betamax, began producing VHS recorders, acknowledging the format’s overwhelming market success. This strategic pivot signified a concession of defeat in the format war, as Sony recognized the consumer and industry shift towards VHS.

Sony’s decision to embrace VHS highlighted the undeniable market trends and the need to adapt to prevailing consumer preferences. This move underscored the extent of VHS’s dominance and the strategic necessity for Sony to align with the format that had captured the market’s favor.