Think times are tough now? Boomers who lived through the 1970s might argue otherwise. From double-digit inflation to gas lines that stretched for blocks, the ’70s were no picnic. Here’s a look at 19 ways the economy back then hit harder—and how those who lived it say today stacks up.

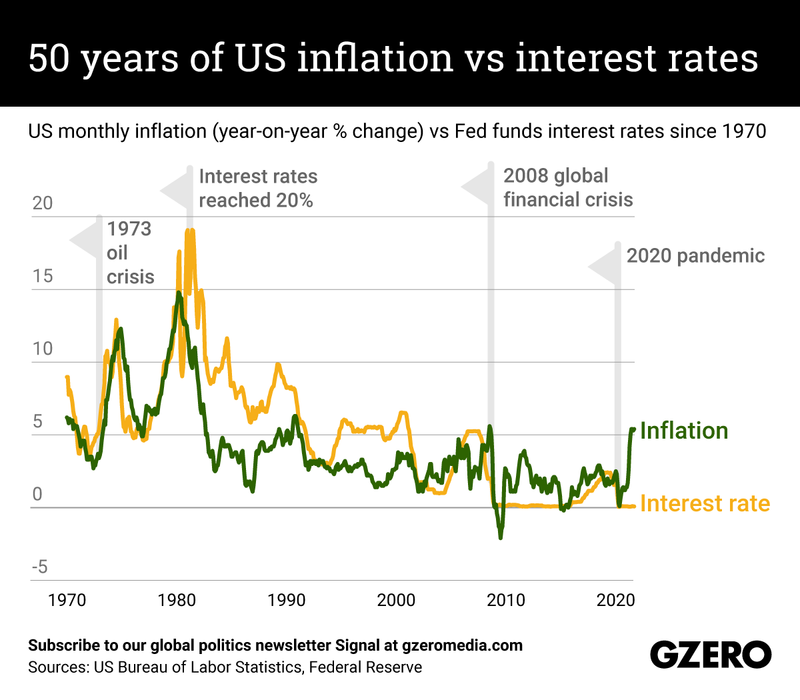

1. Inflation Hit Over 13%

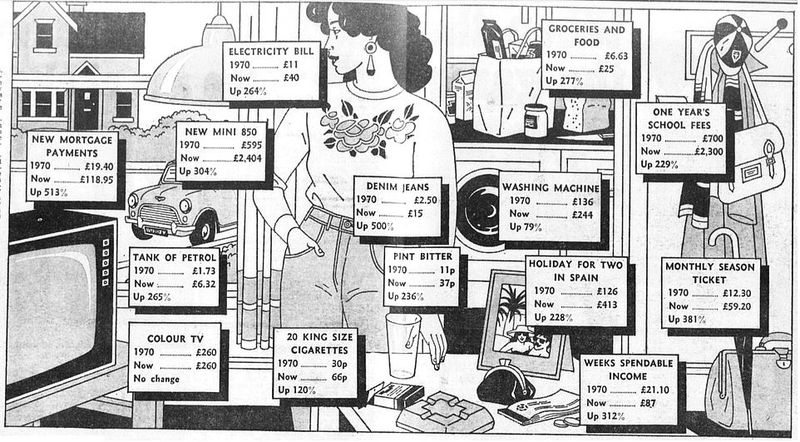

In 1979, inflation soared to a staggering 13.3%, wiping out purchasing power. Groceries doubled in price almost overnight, making everyday shopping a daunting experience. For families, budgeting became a nightmare, as salaries couldn’t keep up with the rising cost of living.

Today’s inflation, while concerning, remains far below these levels. Boomers recall how each trip to the store brought new price shocks, a constant reminder of their vanishing paycheck value.

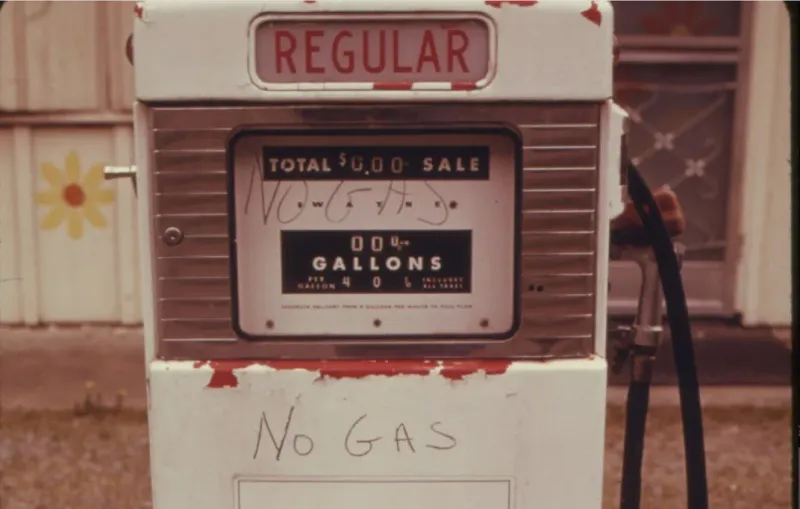

2. Gas Lines Were the Norm

The oil embargo of 1973 led to long gas lines and even odd/even license plate rationing. Drivers would wait hours just to fill up, often running out of fuel while in queue.

Now, while gas prices fluctuate, accessibility is rarely an issue. Boomers remember these lines as a symbol of economic strife and uncertainty, a time when simply getting to work became an ordeal.

3. Stagflation Was Real

The economy suffered the worst of both worlds: high inflation coupled with high unemployment—a phenomenon known as stagflation. Businesses struggled, leading to further job losses.

While economic downturns today are painful, they typically don’t combine these two challenges. Boomers remember the hopelessness, as the economy seemed stuck in a vicious cycle with no apparent escape.

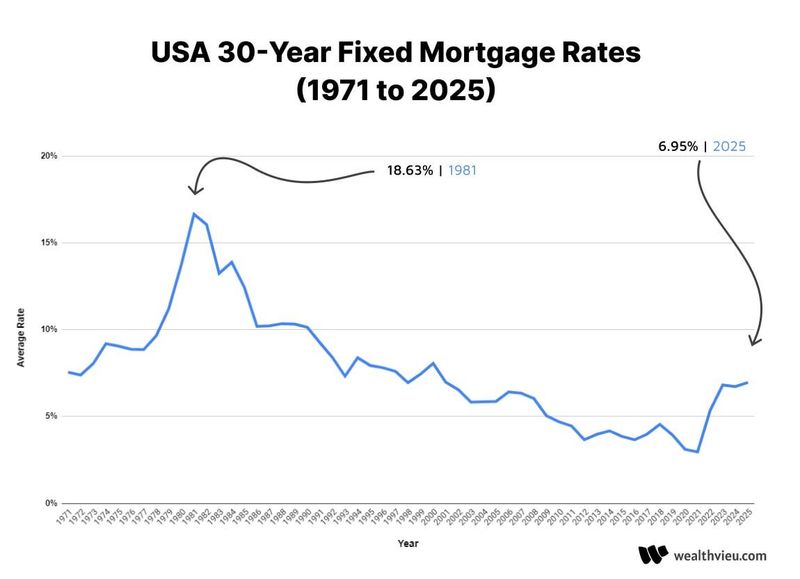

4. Mortgage Rates Topped 18%

In 1981, homebuyers faced mortgage rates nearing 18%. For many, home ownership was a distant dream, as monthly payments became unaffordable. The housing market stalled, trapping families in renting cycles.

Today, with rates in the 6–7% range, older generations laugh, saying, “You’ve got it easy.” They recall the frustration and financial strain of trying to secure stable housing.

5. The Job Market Was Frozen

College grads in the ’70s often couldn’t find work—no matter the degree. Industries were shrinking, leaving young professionals in limbo.

Now, though the job market remains competitive, opportunities feel more abundant. Boomers remember months of job hunting with zero leads, a stark contrast to today’s dynamic job landscape.

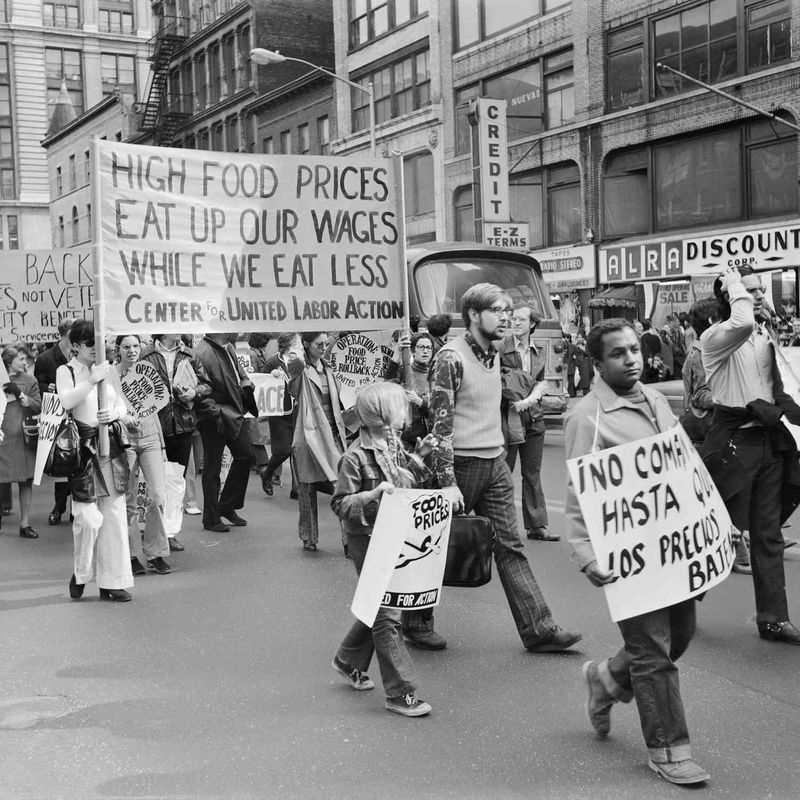

6. Wages Didn’t Keep Up

Paychecks lagged behind soaring prices, making survival a monthly struggle. Real income evaporated as expenses outpaced earnings. Many families found themselves cutting corners just to make ends meet.

Today, wage stagnation concerns persist, but ’70s workers saw their purchasing power diminish faster. Boomers recall the frustration of watching their hard-earned dollars lose value almost immediately.

7. Layoffs Were Constant

Factory and blue-collar jobs vanished seemingly overnight, leaving entire towns jobless. Communities that had thrived on industrial strength found themselves devastated.

Now, tech layoffs dominate headlines, but in the ’70s, there were fewer safety nets. Boomers remember the suddenness of job loss and the difficulty of finding new opportunities in a stagnant economy.

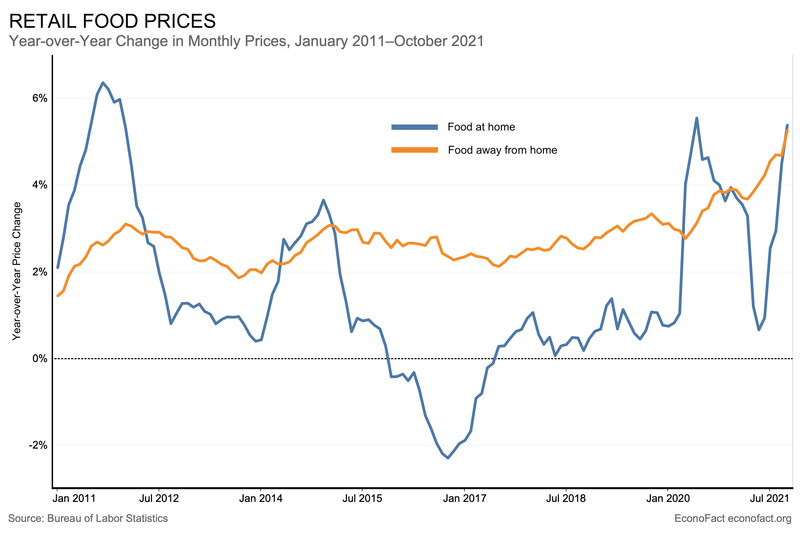

8. Prices Changed Weekly

Supermarket prices weren’t just higher—they were unpredictable. One week, milk might be affordable; the next, it was a luxury. Budgeting became a guessing game as prices shifted constantly.

Today, prices are high but stable by comparison. Boomers remember the anxiety of grocery shopping, never knowing what essentials would cost from one trip to the next.

9. Energy Bills Exploded

Heating costs skyrocketed after oil shocks, and homes weren’t energy efficient. Families bundled up indoors, trying to conserve fuel and stretch dollars.

Now, while utility bills still sting, energy assistance programs and modern insulation offer some relief. Boomers recall shivering through winters, balancing warmth against affordability.

10. Interest Rates Crushed Borrowers

Getting a car or a personal loan meant sky-high interest—often over 10%. Everyday borrowing became a burden, as repayments soared.

Today, credit isn’t cheap but not as crushing. Boomers remember the financial strain of borrowing for essentials, a stark contrast to more manageable rates today.

11. Food Prices Were Volatile

Global shortages and inflation made basic staples—like coffee and meat—luxuries for some. Families adjusted to limited options, often cutting back on essentials.

Now, while prices are up, boomers say they at least stay on the shelves. They recall the difficulty of finding certain items and the shock at their rising costs, contributing to a challenging era for household budgets.

12. The Dollar Was Weak

Currency instability meant imported goods were expensive and unreliable. Travel and buying foreign products became costly endeavors.

Now, the dollar remains strong globally, helping keep import prices competitive. Boomers remember adjusting budgets to accommodate the fluctuating value, a factor that complicated international dealings.

13. Unemployment Reached 9%

In the mid-’70s, unemployment hit 9% and stayed high for years. Job security was a luxury, with many workers uncertain of their futures.

Now, unemployment rebounds faster, even during downturns. Boomers recall the prolonged agony of job searching and the pervasive fear of unemployment.

14. Credit Cards Were Rare—and Expensive

Credit was a privilege, not a tool. Most families couldn’t get cards, and those who did faced outrageous rates. Cash remained king, limiting consumer flexibility.

Now, plastic is everywhere—sometimes too available. Boomers remember the exclusivity and cost of credit, a sharp contrast to today’s consumer landscape.

15. Economic Uncertainty Was Constant

Between Watergate, Vietnam fallout, and energy crises, trust in the economy hit rock bottom. Public confidence in leadership and economic stability wavered.

Now, there’s volatility, sure—but not the same lingering dread Boomers remember. They recount the pervasive uncertainty that hung over every financial decision.

16. Savings Were Eaten Alive

High inflation meant savings lost value daily. People watched their nest eggs shrink, feeling powerless to stop the erosion.

While savings interest still lags inflation, it’s nowhere near as punishing now. Boomers recall the disheartening realization that saving for the future seemed futile, with inflation constantly outpacing interest.

17. Families Cut Way Back

Vacations? Eating out? Forget it. Every dollar was stretched to the breaking point. Families prioritized essentials, with luxuries deemed unaffordable.

Now, even in hard times, many households manage some luxuries. Boomers remember the relentless budgeting and sacrifices, making do with less in hopes of better times.

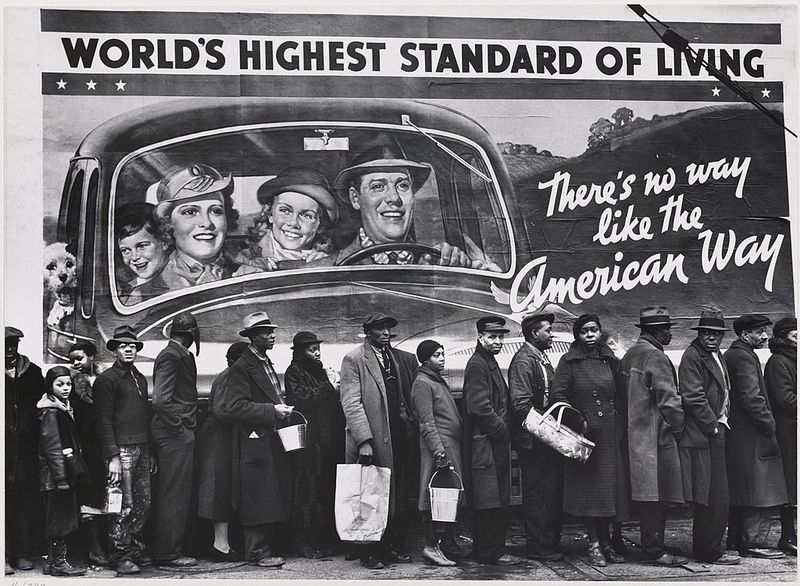

18. Consumer Confidence Was in the Gutter

Americans believed things would get worse before they got better—and they were often right. Media reflected the pessimism, influencing public sentiment.

Now, confidence dips during downturns but tends to rebound faster. Boomers recall the gloom pervasive in societal attitudes and messaging, reinforcing economic anxieties.

19. The American Dream Felt Out of Reach

Home ownership, a steady job, and retirement felt like fantasies to many. Economic conditions dashed hopes of achieving these milestones.

Now, challenges remain, but Boomers say we’re not in the economic nightmare they lived through. They remember the stark gap between aspirations and reality, a time when the dream seemed unattainable.