Warren Buffett, one of the world’s greatest investors, is stepping down after an incredible 55-year run as CEO of Berkshire Hathaway. This historic change marks the end of the longest leadership tenure in S&P 500 history.

Now, at 94 years old, the legendary ‘Oracle of Omaha’ is passing the torch to Greg Abel, who will take control of the massive $1 trillion business empire.

1. Record-Breaking Leadership Tenure

No CEO in modern business history comes close to matching Buffett’s 55-year reign at Berkshire Hathaway. Since taking control in 1965, he’s outlasted generations of business leaders and multiple economic cycles.

Most CEOs last just 5-7 years at major companies. Buffett’s extraordinary longevity allowed him to build relationships with companies spanning decades rather than quarters, giving him unique advantages in deal-making.

2. The 94-Year-Old Business Legend

Born during the Great Depression in 1930, Buffett’s business journey spans nearly a century of American economic history. His sharp mind remains legendary even in his 90s, impressing much younger executives with his mental calculations and memory for business details.

While most of his peers retired decades ago, Buffett continued making multi-billion dollar decisions well into his 90s. His famous annual shareholder letters never lost their wisdom or folksy charm.

3. From Failing Textile Mill to Global Giant

When Buffett first bought Berkshire Hathaway, it was a struggling New England textile company worth about $19 million. Today, it stands as a $1 trillion behemoth spanning insurance, energy, railroads, manufacturing, and massive stock investments.

The company’s transformation required painful decisions. Buffett eventually shut down the original textile operations while building an investment powerhouse. That $19 million initial investment has multiplied over 50,000 times under his guidance.

4. Greg Abel: The New Captain of the Ship

Canadian-born Greg Abel, 62, brings a drastically different style to Berkshire’s leadership. Unlike the spotlight-loving Buffett, Abel operates with quiet efficiency, building Berkshire’s massive energy business from behind the scenes.

Colleagues describe Abel as detail-oriented and methodical. His work ethic is legendary – often starting at 5 AM and continuing late into evenings. Having overseen Berkshire’s non-insurance operations for years, he’s already familiar with managing the conglomerate’s diverse businesses.

5. The 2,800,000% Stock Return Miracle

Imagine turning $10,000 into $280 million! That’s essentially what happened for Berkshire’s earliest investors during Buffett’s tenure. The company’s stock performance over 55 years represents perhaps the greatest long-term investment track record in market history.

A single share of Berkshire Hathaway Class A stock now trades for over $600,000. Early believers in Buffett who invested modest sums found themselves multimillionaires decades later. The performance made Buffett himself one of the world’s richest people.

6. Years of Careful Succession Planning

Unlike many founder-CEOs who cling to power until the end, Buffett meticulously prepared for leadership transition. He publicly identified Abel as his successor back in 2021, though insiders say the selection process began much earlier.

Transparency about succession helped maintain investor confidence. Buffett created a system where Abel could gradually take on more responsibilities while learning directly from the master. This methodical approach aims to preserve Berkshire’s unique culture after its founder departs.

7. The $1 Trillion Business Portfolio

Berkshire’s holdings read like a who’s who of American business icons. The company owns GEICO insurance outright, along with BNSF Railway, Dairy Queen, Duracell batteries, and dozens of other operating businesses employing over 380,000 people.

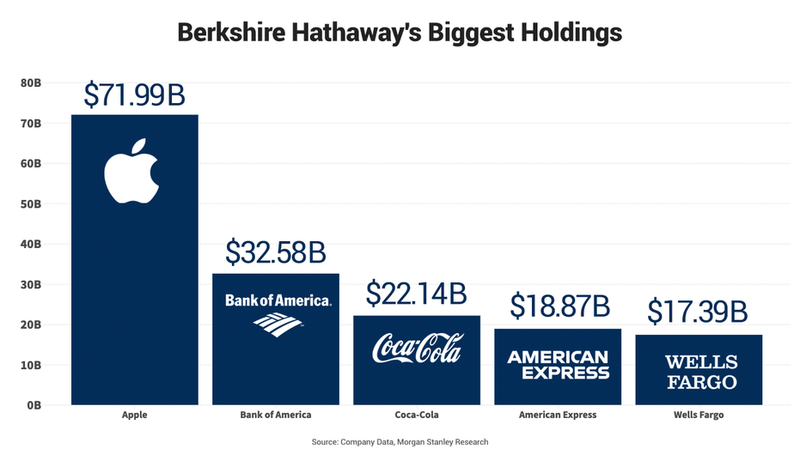

Then there’s the investment portfolio! Berkshire holds massive stakes in Apple (its largest investment), Bank of America, Coca-Cola, and American Express. Abel inherits not just operating businesses but responsibility for a stock portfolio worth hundreds of billions.

8. Buffett’s Semi-Retirement Plan

Don’t expect Buffett to disappear entirely! The nonagenarian investor will continue as Chairman of Berkshire’s board, retaining significant influence over major decisions. His right-hand man Charlie Munger remained active until his passing at 99 last year.

Buffett loves what he does too much to fully retire. He’ll likely maintain oversight of Berkshire’s investment portfolio while gradually ceding day-to-day operational control. For a man who once said his favorite holding period is “forever,” partial involvement seems fitting.

9. The Billionaire With Modest Tastes

Despite amassing a fortune exceeding $120 billion, Buffett lives remarkably simply. He still resides in the same Omaha house he purchased for $31,500 in 1958 – now worth maybe $1 million, a tiny fraction of his wealth.

His breakfast routine? McDonald’s, often determined by stock market performance that day. Instead of private jets (though Berkshire owns a jet company), he drove himself around in a modest car for years. This frugality reflects his investing philosophy: substance over flash, value over hype.

10. The Historic Wealth Giveaway

Perhaps Buffett’s most remarkable legacy isn’t what he built but what he’s giving away. He pioneered The Giving Pledge alongside Bill Gates, committing to donate 99% of his fortune to charitable causes rather than passing it to heirs.

Already, he’s donated over $51 billion to foundations focusing on global health, poverty alleviation, and education. Most of his remaining wealth will go to the Gates Foundation and family foundations after his death. Abel inherits Buffett’s business empire but not his personal fortune.