In an era where financial stability is increasingly elusive, certain habits inherited or observed from the Baby Boomer generation are proving detrimental to Generation X.

This blog post explores 25 specific money habits that, if not carefully managed, could lead Gen X down a path to financial instability.

From outdated saving strategies to risky investment behaviors, each habit is examined to offer insights and potential solutions for a more secure financial future.

1. Over-Reliance on Credit Cards

Credit cards, while convenient, have led many Baby Boomers to develop a habit of spending beyond their means. For Gen X, this reliance can spiral into mounting debt if not managed carefully.

The allure of buying now and paying later might seem like a lifeline during tight financial situations, but it can lead to financial strain. Gen X should prioritize understanding interest rates and pay off balances monthly to avoid high-interest debt.

This strategy not only preserves credit health but also fosters a mindset of living within one’s means, which is crucial for long-term financial security.

2. Ignoring Retirement Savings

Many Boomers neglected retirement savings early on, relying heavily on pensions and social security. As pensions become less common, Gen X cannot afford this oversight.

It’s crucial for Gen X to prioritize retirement savings early, leveraging employer-sponsored plans and personal savings accounts.

Regular contributions ensure financial security during retirement. Missing the opportunity to save can lead to prolonged work years, struggling with insufficient funds.

Taking advantage of compounding interest and employer matches can significantly boost retirement savings over time.

3. Falling For Get-Rich-Quick Schemes

The lure of quick wealth has enticed Boomers into risky ventures, often leading to financial losses. Gen X should be wary of such schemes.

Critical thinking and thorough research are essential before investing in opportunities that promise rapid returns.

Instead, focus on sustainable, educated investment strategies. The appeal of fast money is understandable, but the risks often outweigh the benefits, making this a habit that Gen X should consciously avoid for stable financial growth.

4. Neglecting Health Insurance

Boomers often underestimated the importance of sufficient health insurance, leading to financial distress during medical emergencies. Gen X must not repeat this mistake.

Investing in comprehensive health insurance is vital to protect against unforeseen medical expenses.

Without adequate coverage, even a minor health issue can become a significant financial burden. Ensuring adequate insurance can prevent financial disaster, preserve savings, and offer peace of mind.

5. Overemphasis on Home Ownership

For Boomers, owning a home was a symbol of success, but this mindset can strain Gen X finances if mismanaged.

While real estate can be a valuable asset, purchasing a home beyond one’s means can lead to debt.

Gen X should evaluate their financial situation carefully and consider all costs associated with home ownership, including maintenance and taxes, to avoid financial strain.

6. Lack of Budgeting Skills

Boomers often relied on traditional budgeting methods, which Gen X might find inadequate in today’s economy.

Developing budgeting skills is essential to track spending and ensure financial stability. Utilizing modern tools and apps can make budgeting easier and more effective.

Gen X should focus on setting realistic financial goals and regularly reviewing their budgets to adapt to changing financial circumstances, avoiding overspending and fostering savings.

7. Failure to Diversify Investments

Boomers frequently placed their faith in a limited range of investments, risking significant financial loss. Gen X should learn from these mistakes.

Diversifying investments across different asset classes can minimize risks and enhance returns.

This practice involves spreading investments to include stocks, bonds, and other financial instruments, reducing dependency on a single source and safeguarding against market fluctuations.

8. Underestimating Inflation

Boomers often failed to account for inflation, which erodes purchasing power over time. Gen X needs to be vigilant.

Understanding inflation and its impact on savings and investments is crucial to maintaining financial stability.

Incorporating inflation-protected securities and regular financial reviews can help mitigate its effects, ensuring that savings retain their value over time.

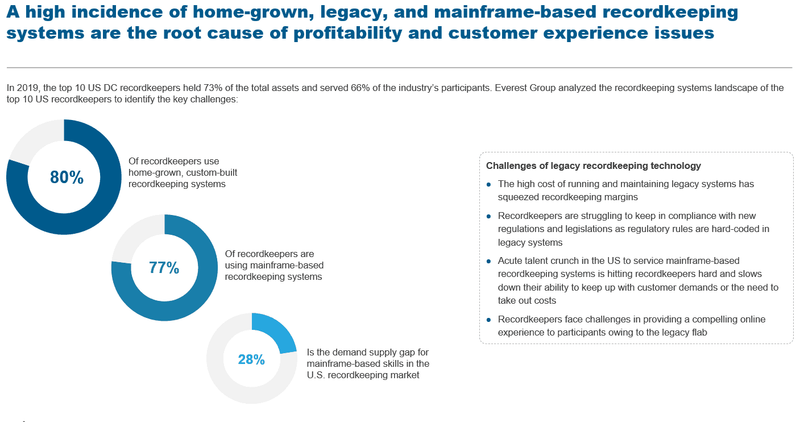

9. Relying on Fixed Pensions

Boomers relied heavily on fixed pensions that are now less reliable for sustaining post-retirement life. Gen X should not count on this.

Exploring diverse income streams for retirement is essential. This might include investment portfolios or part-time work.

Adapting to the evolving financial landscape by seeking flexible retirement income options can provide additional security in one’s later years.

10. Not Planning for Long-Term Care

Boomers often overlooked the potential costs of long-term care, leading to financial strain. Gen X should prepare for this possibility.

Planning for long-term care involves both financial and lifestyle considerations. Insurance options can mitigate costs.

This preparation ensures that future healthcare needs do not deplete savings, offering peace of mind and financial stability during later years.

11. Keeping Up with the Joneses

Boomers often aspired to maintain appearances, leading to unnecessary expenditures. Gen X should prioritize individual financial health over comparison.

Resisting the pressure to match others’ lifestyles can prevent overspending and debt accumulation.

Focusing on personal financial goals and values is essential for achieving long-term financial well-being and avoiding the pitfalls of consumerism.

12. Ignoring Emergency Funds

Many Boomers neglected to build sufficient emergency funds, leaving them vulnerable in crises. Gen X must learn the importance of this safety net.

An emergency fund provides crucial financial security against unforeseen expenses. Regular contributions can build a buffer for unexpected costs.

Establishing such a fund ensures resilience against financial shocks, preserving other savings and investments.

13. Late Adoption of Technology

Boomers often hesitated to adopt new technology, missing opportunities for financial management. Gen X should embrace digital tools.

Utilizing technology for budgeting, investing, and managing expenses can enhance financial control.

Adopting digital tools provides easier access to financial information and planning, facilitating better decision-making and efficiency.

14. Overlooking Tax Implications

Boomers frequently underestimated the impact of taxes on finances, leading to unexpected liabilities. Gen X should be tax-savvy.

Understanding tax laws and implications is crucial for effective financial management. Proactive tax planning can reduce liabilities.

This awareness can optimize financial strategies, enhance savings, and ensure compliance, preventing unforeseen financial burdens.

15. Purchasing on Impulse

Impulse buying can lead to cluttered homes and depleted bank accounts, a habit some Boomers fell into. Gen X must exercise restraint.

Mindful purchasing decisions can prevent unnecessary expenditures and financial strain.

Considering needs versus wants before making purchases helps in maintaining budgetary discipline and achieving financial goals.

16. Underfunding Education

Boomers sometimes underestimated the rising cost of education, affecting financial planning. Gen X should prioritize educational funding.

Investing in education, whether for oneself or children, requires careful financial planning to avoid debt.

Setting up education savings plans early ensures that educational goals can be met without compromising financial stability.

17. Ignoring Estate Planning

Boomers often postponed estate planning, leading to complicated legal issues later. Gen X should prioritize this process.

Estate planning ensures that assets are distributed according to one’s wishes, minimizing legal complications.

Engaging in early estate planning provides clarity and security for future generations, preventing potential disputes and ensuring peace of mind.

18. Skimping on Insurance

Boomers sometimes compromised on insurance coverage to save money, risking financial security. Gen X should understand insurance needs.

Adequate insurance is vital to protect against significant financial losses. Evaluating and updating policies regularly is crucial.

Comprehensive coverage can prevent unexpected expenses from draining savings, providing a necessary safety net.

19. Mismanaging Debt

Boomers often accumulated debt without effective management strategies, leading to financial distress. Gen X should learn to manage debt wisely.

Developing a clear debt repayment plan can reduce financial stress and improve credit health.

Avoiding high-interest debt and prioritizing payments ensures better financial management and long-term stability.

20. Failing to Set Financial Goals

Without clear financial goals, Boomers sometimes drifted financially without direction. Gen X should set specific, achievable goals.

Establishing clear financial objectives guides budgeting, saving, and investing decisions.

Regularly reviewing and adjusting goals ensures progress and adaptation to life changes, fostering financial success and stability.

21. Avoiding Professional Financial Advice

Boomers often hesitated to seek professional financial advice, missing valuable insights. Gen X should embrace expert guidance.

Financial advisors provide tailored strategies that align with individual financial situations and goals.

Engaging professionals can lead to better financial decisions, offering expert perspectives and enhancing financial outcomes.

22. Overlooking Passive Income Opportunities

Boomers sometimes focused solely on active income, missing passive income potential. Gen X should explore these opportunities.

Investments in real estate or businesses can generate passive income, diversifying income streams.

Exploring passive income options adds resilience and financial growth, contributing to long-term wealth accumulation.

23. Overspending on Vacations

Boomers often prioritized extravagant vacations, leading to financial strain. Gen X should balance leisure with financial responsibility.

Planning vacations within budget ensures enjoyment without debt.

Mindful spending on travel allows for memorable experiences while maintaining financial health, avoiding the post-vacation financial hangover.

24. Neglecting Environmental Costs

Boomers often overlooked the financial impact of environmental inefficiencies at home. Gen X should consider sustainability.

Investing in energy-efficient appliances and practices can significantly reduce bills.

Sustainability not only cuts costs but also benefits the environment, aligning financial savings with ecological responsibility.

25. Underutilizing Financial Education

Boomers sometimes undervalued ongoing financial education, limiting growth. Gen X should prioritize learning.

Staying informed about financial trends and strategies enhances decision-making and opportunities for savings.

Continuous financial education empowers individuals to adapt to changes, optimize strategies, and achieve financial success.